– The stock market continues to rise to uncharted levels,

– Even in a bull market there are buying opportunities,

– Today we will look at how investors can find stocks that outperform the market,

– We leverage ProPicks, an AI-powered stock selection tool,

– ⚠️ LIMITED PRICE LOCK, THANKS TO THE SUMMER DISCOUNT of -31% on the 1 YEAR Pro+ subscription! Take advantage of InvestingPro+’s AI strategies and investment assistance tools, CLICK HERE to take advantage of the offer before it ends, and pay only 52 cents a day⚠️

Let’s imagine. Despite the market’s rises in recent months, we manage to find undervalued stocks that have the potential to rise by more than 20%.

The model that can inform us of the existence of an undervalued (or overvalued) security and consequently indicate a long potential is the tool of InvestingPro Fair Value.

How fair value works

Traditionally, determining the “true” value of a company requires complex financial models that analyze large amounts of financial data. These models often require a deep understanding of financial principles and complex calculations.

However, you can simplify the judging process by using InvestingPro’s Fair Value tool.

The indicator, an exclusive feature for InvestingPro subscribers, uses various valuation models to analyze a company’s financials and cash flow and provides a target price for each stock. This allows investors to easily evaluate the potential value of a stock without requiring in-depth financial expertise. InvestingPro aggregates and interprets complex data to help investors make informed decisions.

Let’s look at the example mentioned below. After InvestingPro suggested that it was trading significantly below its Fair Value, it subsequently reversed the downtrend to post high returns.

Bank Mediolanum (BIT:) SpA rose by +30% after confirmation of undervaluation according to the Fair Value Pro of August 1, 2023

Banca Mediolanum SpA had a bearish second part of 2023, reaching a minimum of 7.6 euros, at the same time it saw the formation of a bullish “descending wedge” pattern which in the following weeks it confirmed the “underestimated” reading of the Fair Value Pro. The stock rose by over 45%from the lows of October 2023 to 10.91 euros, recovering the now distant levels of 2001.

However, after reaching that peak, it moved sideways, and is currently above 10.50 euros. Despite the recent decline, Mediolanum still holds a solid 25% year-to-date return.

So was the rise in Mediolanum shares predictable?

Analysts weren’t the only ones who saw an opportunity in the stock at the time, as Pro valuation models also pointed out that the stock appeared undervalued based on fundamentals. In other words, InvestingPro subscribers were alerted to the bullish potential, not based on a hunch, but based on hard financial data.

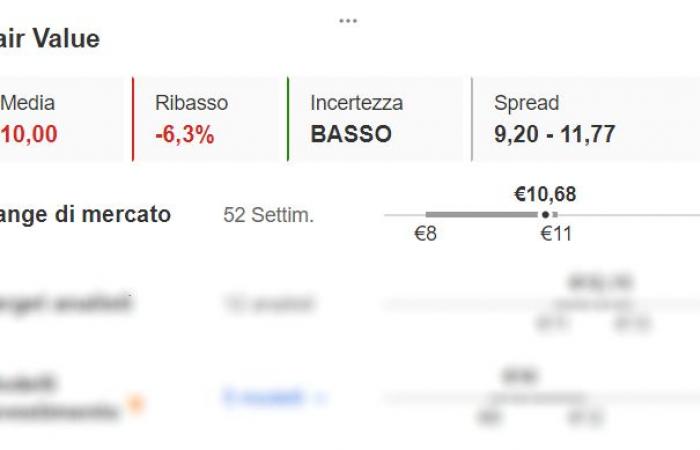

Fair Value of InvestingPro’s Banca Mediolanum shares is currently 10.00 euros, corresponding to a modest drop of over 6%

With a Pro subscription, however, you will be able to see not only the Fair Value, but also the Health Score and ProTips of all stocks, use basic screening functions, access AI-driven outperforming ProPicks strategies, and much more !

SUMMER SALES FOR A LIMITED PERIOD: DO YOU WANT TO KNOW THE MOST NUMBERS OF DATA ON THE MARKET BUT YOU ARE NOT SUBSCRIBED TO InvestingPro+? now is the perfect time to do it: THANKS TO THE SUMMER DISCOUNT of -31% on the 1 YEAR Pro+ subscription (COUPON: PROM24)

You can also CLICK HERE to learn more about InvestingPro+ by watching our recorded webinars!

Until next time!

– (NEW) Watch my monthly analysis on the major indices:

Watch the recording of my latest PRO+ Webinar:

So you don’t miss my analysesreceive updates in real time, click on the button [SEGUI] of my profile!

“This article was written for information purposes only; it does not constitute a solicitation, offer, advice, consultancy or investment recommendation as such it is not intended to encourage the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky and therefore, every investment decision and the related risk remain the responsibility of the investor”.