The rules for the biennial composition with creditors they were put down in black and white on the eve of the debut scheduled for today, June 15th.

Here comes the implementing decree which establishes the calculation rules of the proposal agreement between the Revenue Agency and VAT numbers: reduction of the highest income by 50 percent to encourage VAT numbers.

The deputy minister Maurizio Leo signed the provision which adds the three missing pieces, also relating to the exceptional circumstances that generate losses and allow taxpayers to cancel the agreement with the financial administration.

The text was also published late in the morning Official Journal in record time.

In the meantime, we are also waiting for the day publication of the software for sending data by theRevenue Agency but while everything seems to be ready, corrections to the legislation provided for by legislative decree number 13 of 2024 have already been announced and will arrive in the Council of Ministers next week.

Biennial composition with creditors: the text of the MEF decree for the calculation signed at the last minute

Having acquired the opinion of Guarantor for the protection of personal datarendered on 6 June 2024, on Ministry of Economy and Finance in the figure of deputy minister Leo approved the decree defining the methodology for the development and adhesion to the 2024 composition with creditors proposal.

The text consists of 8 articles and, in addition to approving the method, yes calculation and to clarify object and temporal scopeor income from self-employment, business and value of net production relevant for the purposes of the regional tax on relevant productive activities, for the tax periods in progress at 31 December 2024 and 31 December 2025, also defines the framework of rules on which the agreement between tax authorities and VAT numbers.

- Ministry of Economy and Finance – Decree of 14 June 2024

- Methodology for the preparation of the biennial preventive agreement

First of all to encourage taxpayers tomembership a was foreseen gradual accompaniment to the figures that emerge from the calculation:

“In order to guarantee the gradual achievement of a level corresponding to full reliability at the end of the two-year period covered by the agreement, the proposal for the tax period in progress on 31 December 2024 relating to the income referred to in article 3, paragraph 1, letters a) and b), takes into account those declared for the tax period in progress as of 31 December 2023 and, to the extent of 50%, the highest income identified with the methodology set out in Annex 1″

It can be read in article 5 of MEF decree of 14 June 2024.

Agreement with the Revenue Agency on the payment of taxes

Are you thinking of joining?

Comments via email to the editorial staff by writing to the address [email protected] with subject: “agreed”.

Biennial composition with creditors: cases of reduction of taxes owed

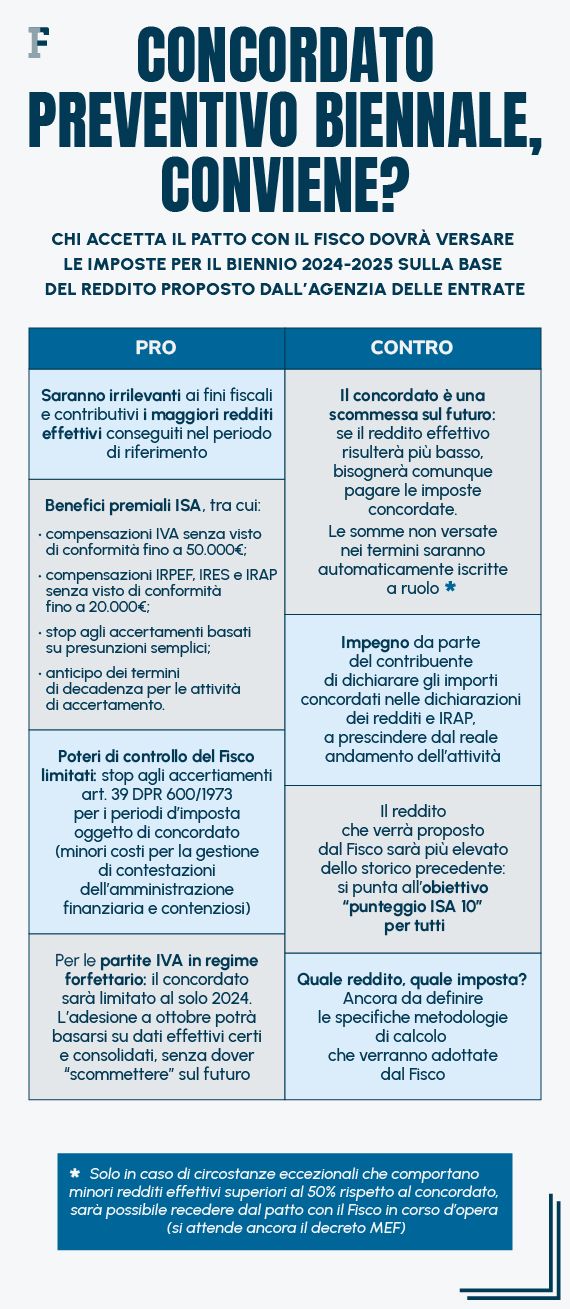

But the agreement with the tax authorities it may last less than two years or undergo variations.

The effects of the agreement will cease in the event of lower actual incomes or lower actual net production values, over 50 percent in the presence of the following exceptional circumstances:

- calamitous events for which a state of emergency has been declared and other extraordinary events;

- ordinary liquidation, compulsory administrative or judicial liquidation;

- lease of the sole company;

- suspension of the activity for administrative purposes by notifying the Chamber of Commerce, Industry, Crafts and Agriculture;

- suspension of the practice of the profession by communicating this to the professional association to which one belongs or to the social security and welfare institutions or to the competent funds.

The provision also establishes the rules for the adaptation of the proposed agreement relating to the tax period in progress as of 31 December 2024, taking into account possible extraordinary events communicated by the taxpayer for a reduction in income and net production compared to what is proposed.

| Agreed reduction percentage | Conditions |

|---|---|

| 10 percent | extraordinary events which resulted in the suspension of economic activity for a period of between 30 and 60 days |

| 20 percent | Extraordinary events that led to the suspension of economic activity for a period exceeding 60 days and up to 120 days |

| 30 percent | Extraordinary events which led to the suspension of economic activity for a period exceeding 120 days |

The events to refer to for the adjustment are all those mentioned previously apart from the ordinary liquidation, forced administrative or judicial liquidation and the leasing of the single company.