Breaking News

Asian stocks ended the week on a low note after hitting 26-month highs at the start of the week. Profit taking, while the strength of the US dollar, due to rate cuts by European central banks, continues to put pressure on the yen. The Swiss National Bank cut rates for the second time on June 20, while the Bank of England opened the door to easing in August after keeping rates unchanged. The pound, Swiss franc and euro fell, pushing the dollar higher, while weak data from the United States strengthened bets on two rate cuts by the Fed by the end of the year.

The tech stocks reverse and the Nikkei moves to parity. Inflation accelerates in Japan

The Japanese Nikkei is almost stable at 38,606 points (-0.07%) with the dollar-yen exchange rate at 158.88 (+0.5%), but in the intraday it reached 159, its lowest level since late April, when Japanese authorities intervened in the market to curb the currency’s rapid declines. The latest data shows that Japanese inflation has accelerated due to rising energy costs, a result that supports the case for an increase in interest rates in the coming months. Consumer prices, excluding fresh foods, increased 2.5% in May compared to a year ago (2.2% in April). The figure was slightly lower than economists’ estimate, but remained above the Bank of Japan’s 2% target for the 26th month.

“The Nikkei was doing well, then was halted by drops in chipmaker stocks” in the wake of sell-offs on the Nasdaq, said Seiichi Suzuki, an analyst at the Tokai Tokyo Intelligence Laboratory. “The fall in the yen was good for exporters and higher yields pushed value stocks higher.” Chip test equipment maker Advantest fell 1.92%, the biggest drag on the Nikkei. Chipmaking equipment maker Tokyo Electron lost 0.63%. The electronic component manufacturer Tdk 2.66%. Some value stocks did better, such as the heavy machinery manufacturer IHI, which rose by 6.97%.

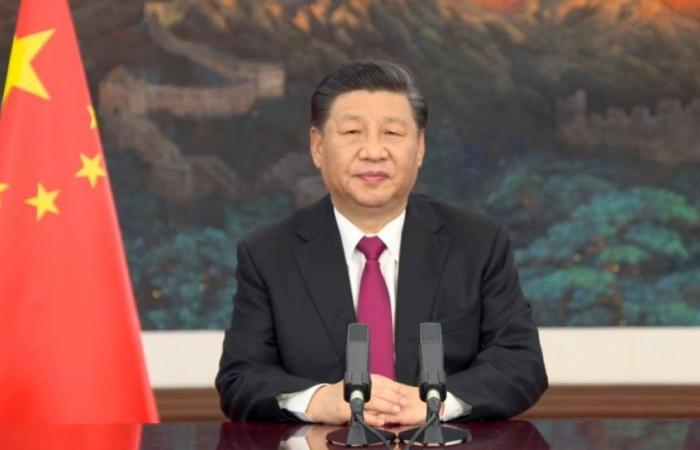

Chinese stock markets are doing badly, with 33 billion yuan (4.54 billion dollars) leaving China

Due to the strength of the US dollar and the decline in technology stocks, Chinese stocks fell, also because the portfolio flows of foreign investors changed. About 33 billion yuan ($4.54 billion) left mainland China this month after four months of inflows. The Stock Connect program has seen outflows of about 129 billion yuan from mainland China to Hong Kong since the start of the year. Additionally, investors are cautious as the Chinese Communist Party’s central committee will meet in July, a key meeting, known as the Plenum, for reforms. “For the Third Plenum we expect the reform focus to be on containing risks and growing potential in China,” Goldman Sachs analysts said. “Rather than an explosive policy initiative, we expect a continuation, or even an increase, of current measures over a multi-year horizon.”

Furthermore, Bloomberg writes that Canada will soon announce a series of tariffs on Chinese electric cars, a measure that follows similar ones in the United States and Europe. The Shanghai composite index lost 0.60% and Hong Kong’s Hang Seng index lost 1.7%. The Kospi index of South Korea also performed badly, as it did not join the club of developed markets: it remains an emerging country. This is what MSCI decided in its review. The stock index company explained that the lack of promotion, which Seoul had long requested, was due to the reintroduction of the total ban on short selling. On the raw materials side, oil prices retreated slightly after reaching seven-week highs at the start of the week. Brent futures slipped 0.06% to $85.66 a barrel, while US crude fell 0.05% to $81.25 a barrel. Gold prices are stable at $2,358.83 per ounce. (All rights reserved)