The S&P 500 ended a three-week streak of gains, despite a pause in Wall Street’s rally on Thursday and Friday. The highlight of the week was the rise of NVIDIA Corporation (NASDAQ:), which briefly rose to the position of the company with the largest market capitalization in the world. Even so, the index dealt with mixed economic data and profit-taking ahead of a major $5.5 billion options expiration event, ending the week up 0.6%. This period of activity saw the S&P 500 surpass the 5,500 point level for the first time, marking its 31st all-time high of the year. Likewise, the rose by 1.5%, while the remained unchanged.

More notable was the broader participation in this week’s rallies. The equally weighted S&P 500 index reversed the negative trend of four consecutive weeks of decline, closing with an increase of +1.17%. While the S&P 500 has recorded a year-to-date performance of around 15%, the equally weighted index has reported a single-digit increase of +5.2%. The ratio between the two indexes (RSP/SPX) is declining for the third consecutive month, indicating that the equally weighted index is underperforming for the second consecutive year.

Influencing this narrative has been the history of AI. Technology, which weighs 32% on the S&P 500 (only 14.96% in the same equally weighted index), contributed to more than half of Wall Street’s rise, representing 8.48% of the total performance of the 15 .29% of the general index. Nvidia, from Wall Street’s hero, increasingly seems to become the main concern of investors. The stock contributed more than half of the same performance as the technology sector, with a year-to-date return of 155.62% (second only to Super Micro Computer) and a contribution of 4.80%. While the company has reported the highest revenue growth over the past 12 months (+208%) among stocks in the S&P 500, it also leads the ranking of companies in the index with the highest forward Price/Sales ratio (24x). Nvidia insiders also sold more shares in the past month than ever before (zero purchases and $427 million in sales), generating new questions.

Economically, growth of 2.9% (adjusted for inflation) over the past four quarters exceeds the average over the past decade, indicating that the economy is operating above its long-term potential. Additionally, the unemployment rate has remained below 4% for 30 consecutive months, the longest period of low unemployment since the mid-1960s.

Despite these positive indicators, consumer sentiment appears misaligned. The University of Michigan’s consumer sentiment index fell to a seven-month low in June, reflecting a more pessimistic view of personal finances and overall economic conditions. This index is 30% below the pre-pandemic level and only slightly above the 2008-2009 average. By contrast, the Conference Board’s consumer confidence index, which tends to be more influenced by working conditions, is more optimistic, although the June reading is still 20% below its pre-pandemic level.

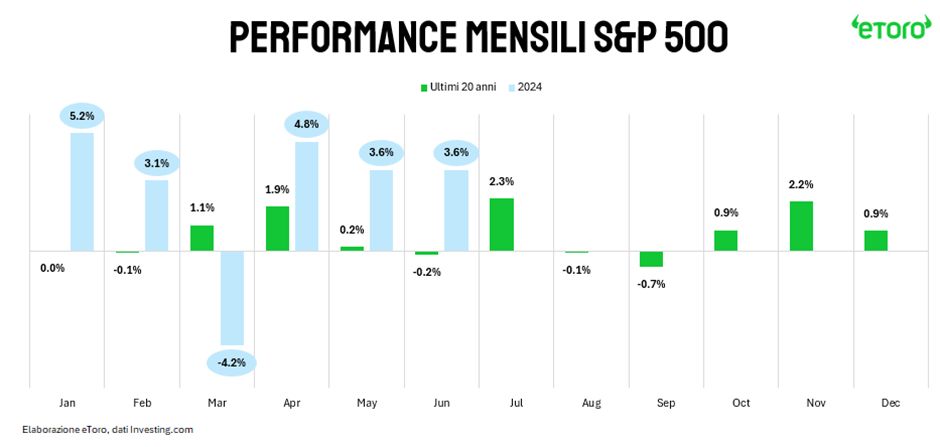

The S&P 500 has gained 15% since the beginning of the year. Seasonal patterns suggest the rally could continue in the coming weeks. Historically, July has been a winning month 75% of the time over the last 20 years, with an average return of 2.3%. The latest performances have already been particularly strong: the index has risen so far by 4% in June (historical average: -0.2%) and by 4.8% in May (average: 0.2%). Given this exceptional performance, the seasonal trend may have already been priced in in advance. However, expected summer weakness could provide new strategic positioning opportunities for the rest of the year.

Inflation will be in focus this week, with market participants looking to May personal income and spending data in the United States. The report will contain a reading of the Personal Consumption Expenditures (PCE) price index, widely regarded as the Federal Reserve’s preferred gauge of inflation. Economists expect core PCE to rise 0.1% month-over-month and 2.6% year-over-year, marking a deceleration on both fronts compared to April. The core PCE price index remained stable at 2.8% year-on-year over the previous three months, and this trend is expected to continue. A positive surprise could fuel hopes of further interest rate cuts, impacting the dollar and the pair. US economic growth will also be in focus on Thursday, with the release of the second estimate of 1st quarter gross domestic product growth.

In Europe, the economic calendar will be relatively calm as markets look ahead to the first round of elections in France on June 30. Investors will closely follow preliminary inflation reports from France, Italy and Spain, as well as the euro area economic survey.

As for the earnings calendar, some big names are expected. The world’s largest cruise line operator, Carnival (LON:), and the global economy’s bellwether, FedEx, will report quarterly results on Tuesday. Over the past four years, Carnival has tried to return to profitability, while FedEx is expected to post an 8.1% increase in earnings per share compared to the same quarter a year earlier.

On Wednesday, numbers from Cheerios parent company General Mills and memory chip maker Micron Technology will be in the spotlight. Expectations for Micron are high, as the chipmaker is already up 69% this year on the back of NVIDIA. On Thursday, it will be the turn of the Walgreens Boots Alliance pharmacy chain and the world’s largest shoe manufacturer, Nike (NYSE:), to present their financial statements. Nike, in particular, will face pressure to improve its market performance and keep pace with competitors.

Gabriel Debach

eToro Italian Market Analyst

Disclaimer: The content of this newsletter is of an informative and educational nature and cannot be considered as financial consultancy or as an investment recommendation.

Past performance is not indicative of future performance. Trading is risky and it is recommended to only risk the capital you are willing to lose.

You should seek advice from an independent and duly authorized financial advisor and ensure that you have the appropriate risk appetite, experience and knowledge before deciding to invest. Under no circumstances will eToro have any liability to any person or entity for (a) any loss or damage, whether in whole or in part caused by, due to, or relating to any CFD related transaction or (b) any direct, indirect , special, consequential or incidental.

Cryptocurrency markets are unregulated services and are not controlled by any specific regulatory framework in Europe (including MiFID) or in the Seychelles. Therefore, when using our Cryptocurrency Trading Service you will not benefit from the protections available to clients receiving investment services regulated (as applicable) by MiFID, such as access to the Cyprus Investor Compensation Fund (ICF)/Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service for dispute resolution, nor the protections available under the Seychelles regulatory framework.