According to Simon Popple, investor and gold analyst, gold still has advantages, such as credible inflation hedge, rarity and limited availability, and relatively low correlation with other assets.

Gold may not seem like the most exciting investment these days, but according to investor and analyst Simon Popple, CEO of Brookville Capital, the precious metal may still deserve a place in your portfolio in these turbulent times.

Gold is usually considered a hedge against inflation. Indeed, as inflation eats away at your dollars, the price of each ounce of gold simultaneously increases in dollar terms, leaving you with a more valuable asset.

In recent months, several countries around the world have experienced high inflation, a surge in interest rates and the cost of living, as well as growing economic and geopolitical uncertainty. In these scenarios, investors have turned more to precious metals, such as gold and silver.

As Popple says, “Gold has been around for thousands of years and is recognized as a valuable asset around the world. Regardless of the social, political or financial climate, gold has never gone to zero or defrauded an investor. It is the ultimate form of money.”

Why is it still worth investing in gold?

Gold has a huge advantage over fiat currencies in the sense that its quantities are limited and countries cannot produce more gold than is available for mining. On the other hand, fiat currencies can be printed by governments at will, and overprinting often contributes to disastrous consequences such as hyperinflation.

Popple points out: “We must remember that fiat currencies are essentially backed by the governments that issue them. The logic is compelling, but if too much money is printed, purchasing power declines and inflation invariably occurs, causing the currency to lose value. rate. “Imagine having a cake, no matter how many times you cut it, it doesn’t get any bigger!”.

Popple also highlighted how printing more money can work as a monetary easing measure at first, but sooner or later it almost always leads to an increase in inflation.

Another advantage is the liquidity of the metal., which is easily convertible into fiat currencies. Gold is also consistent across countries, while items such as currencies, properties and assets tend to vary significantly across the world.

Gold’s low correlation is advantageous

Gold also has a relatively low correlation with most other assets. On the other hand, very similar factors impact assets such as stocks and bonds, which broadly follow the same directions, in terms of market movements.

Popple stated that “one of the main characteristics of gold is its low correlation with traditional assets. This means that when other investments fluctuate during times of stress, gold often moves in the opposite direction or remains relatively stable. This low correlation makes gold an effective tool for balancing a portfolio. “Adding it to your investment mix can reduce the overall risk of your portfolio and increase its stability.”

Gold has also performed well in times of high debt, as Popple notes. “In general, when debt has increased, gold seems to have followed. It’s important to remember that there have been times when debt has gone up, but gold has gone down. However, over the long term (over ten years), gold appears to have done well.”

“The good thing is If the currency in which my other investments are invested has fallen, I can convert my gold into another currency or, if I want, I can convert it back to the same currency. It’s up to me to decide. For example, let’s say the pound has depreciated against several major currencies, such as the US dollar, the euro and the yuan. If I invested some of my money in gold, I don’t care what happens to the currencies, it’s the price of gold that interests me.”

Direct or indirect investments in gold

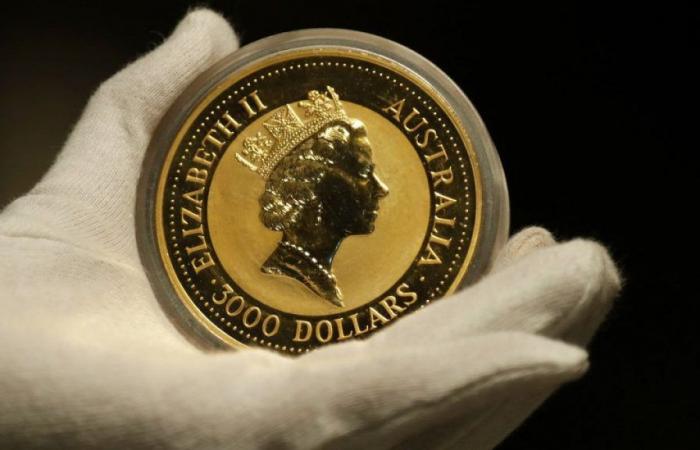

Investments in gold can be made either directly, through gold bars, gold coins and jewelry, or indirectly, through exchange-traded funds and shares of mining companies. Often, novice investors choose to invest in gold indirectlyto get a feel for the market before venturing in-depth.

However, gold is not an interest-bearing assetwhich means that in a high interest rate environment, like the one most of the world is currently in, investors may still be a little hesitant to invest in gold.

Asked if he thinks investors are willing to choose gold over other yielding assets, Popple said that “everyone should have a diversified portfolio, which should include gold. I’m a big believer inthe importance of ‘time on the market‘, rather than ‘market timing’, so I would suggest entering the market. If people are worried about timing, they can always get into a time frame.”

Gold vs Bitcoin: Who Seems to Win

In recent years, after the exponential rise of Bitcoin, cryptocurrency has also been seen as a kind of inflation hedgealthough some investors are still skeptical, due to the particular volatility of cryptocurrencies.

Regarding his position on the ongoing debate between gold and bitcoin as an inflation hedge, Popple considers that “gold has a track record, while Bitcoin does not. Personally, I prefer something concrete. With Bitcoin so expensive, I don’t feel comfortable buying it now. I know supply is limited and so the price has remained reasonably high, but countries like to control the money supply and if there was ever a crisis, I think Bitcoin could be a target – perhaps its use could be banned .

“This is not to say that I am totally against it, but I would prefer to have my gold investments first. If they are all clear (and they aren’t yet!) and I have some free capital, then a small exposure to Bitcoin could be considered, but gold is my priority.”

Disclaimer: This information does not constitute financial advice.; Always do your research to make sure they are right for your specific situation. We also remember that ours is a journalistic site and that our goal is to provide the best guides, suggestions and advice from experts. If you rely on the information contained on this page, you do so at your own risk.