In this article we see some future predictions of crypto market prices, with a particular focus on Bitcoin and altcoins such as Ethereum.

There are several factors that influence the possible scenarios between now and the end of 2024, but it seems that experts agree that there will be a generally bullish second half of the year. The bull run may not be over yet.

All the details below.

Trends that could influence future price predictions

According to the latest study by Ryan Lee, chief analyst at Bitget Research, crypto market forecasts will be influenced by multiple factors.

Both Bitcoin and altcoins are reeling in uncertainty, with the latest price trend appearing to go for retracement but without excessive violence.

At this point, it is likely that forecasts of price developments by the end of the year will depend on the outcome of 3 very important events.

First of all, as Ryan Lee reminds us, the performance of the crypto industry is strongly influenced by global macroeconomic dynamics.

If the Fed initiates a tightening easing monetary policy with at least 1-2 cuts by the end of 2024, we could see a strong return of liquidity to the market.

This is because a rate cut policy would push US investors to look for risk-on assets by moving away from the current high yield bonds.

We are already starting to notice the first positive signs, with the US M3 money supply appearing to be returning to incorporating liquidity at a positive pace after a period of stoppage.

Another vector of possible shocks in the crypto market concerns the future result of the US presidential electionexpected for November.

Bitcoin and altcoin price forecasts will be more optimistic than usual if Donald Trump becomes the 47th president of the United States.

In fact, unlike Biden, the Republican is more favorable to the expansion of the cryptographic sector, so his victory could bring positive sentiment.

Recall that approximately 20% of the US population owns cryptocurrencies.

Finally also the outcome of the spot ETH ETFswhich could potentially land on Wall Street by July 4th, will be crucial in understanding the direction of the market.

If the inflow of capital into new exchange-traded funds for ether reaches the same numbers recorded by Bitcoin, there could be a sharp rise in prices.

The increase in institutional demand for Ethereum could even push for a supply shock, also supporting the altcoin sector.

The market capitalization of the entire crypto sector and Bitcoin dominance

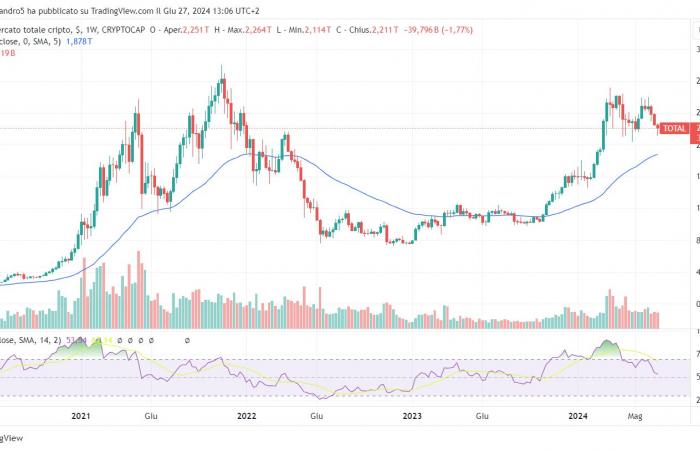

Before analyzing the possible forecasts of Bitcoin and altcoins, let’s focus on the state of the total capitalization of the crypto market.

At the moment the overall value of the crypto token industry is $2.21 trillionup 35% since the beginning of the year.

If we take the beginning of 2023 as a reference, growth rises to around 190%. Since March, however, it has lost 20% of its prices.

It is clear that after the shock of 2024, the market capitalization has recovered strongly, reaching the maximum zone without exceeding it.

According to Bitget Research forecasts, under the influence of the above key factors, a marketcap is expected to arrive between 2.5 and 3.5 trillion dollars at the end of the year.

This translates into a substantial increase in the prices of the major assets in the market.

It should also be underlined that the growth in Bitcoin’s dominance has accompanied the increase in the capitalization of the crypto sector.

Since January 2023 this index has grown by approximately 29%, signaling a confluence of capital around the main currency. In the same period, altcoins lost ground in favor of stablecoins, namely Bitcoin.

From here on out, it is possible that dominance will continue to increase by the end of the year, with forecasts however speaking of a possible reversal.

A sharp decline in Bitcoin dominance, combined with a situation of stability in BTC prices, could trigger an altseason bullish phase.

As a guideline, watch out for the potential breach of the 50% threshold.

Crypto Analysis: Price Predictions for Bitcoin and Altcoins for the End of 2024

Having arrived this far, let’s see what the price forecasts estimated by Bitget Research are for the end of 2024.

Given the current trends and scenarios that could affect the crypto landscape, if there are no negative surprises we would have a positive price action in the coming months. The bullish phase is expected for the end of summer or the beginning of autumn, with an acceleration of the trend in the last months of the year.

In detail Bitcoin forecasts speak of a price range between 70,000 and 100,000 dollars. The break of the historical highs seems only a matter of time, with the asset remaining steadily above $60,000.

On the altcoin front, tokens belonging to the Ethereum and Solana ecosystems will have the opportunity to take advantage of the potential growth of their gas tokens.

Ethereum, as the top 2nd coin on the market, it is expected in a price range between 5,000 and 8,000 dollars. In such a context it could even outperform Bitcoin after a long period of underperformance.

Also worth mentioning is the possible attractiveness of memecoins in a situation of optimism on the crypto exchanges, which will probably still be able to attract large amounts of capital.

London-based bank Standard Chartered also agrees that Bitcoin could reach the $100,000 mark by the end of the year.

The same financial institution also predicted a maximum price of 250,000 dollars at the end of the 2025 bun run.

On the altcoin front, more precisely in Ethereum, Standard Chartered is equally optimistic, aiming for a maximum price of 14,000 dollars at the end of the year.

The performance of ETH spot ETFs will be decisive for the outcome of the ether market: all investors are currently waiting for the start of trading of these products.