3 min

The point on what happened and the expectations, by Francesco Casarella, Italy manager of Investing.com

The week of recovery just ended, especially for the European area, with the main indices positive. America also closed well overall, albeit with a partial rotation that sees Dow Jones doing better than Nasdaq, with Nvidia, the stock at the center of the recent rally, leaving around 10% on the ground in the last two days.

Below is the summary of the weekly performances of the main stock indices:

- Euro Stoxx 50: +1.18%

- FTSE 100: +1.12%

- DAX: +1.02%

- Nikkei: -0.50%

- Dow Jones: +1.45%

- FTSE MIB: +1.97%

- S&P 500: +0.61%

- Nasdaq Composite: +0.03%

Key events

Last week, the key event was undoubtedly European inflation, which was in line with expectations and with monthly and annual variations that better justify the first rate cut carried out by the ECB.

As regards the coming week, however, the focus is on Friday, with the data on the consumer spending price index. As always, a lower-than-expected figure could be positive for the markets (and vice versa) as it would incentivize a first rate cut for the Fed too, perhaps in September.

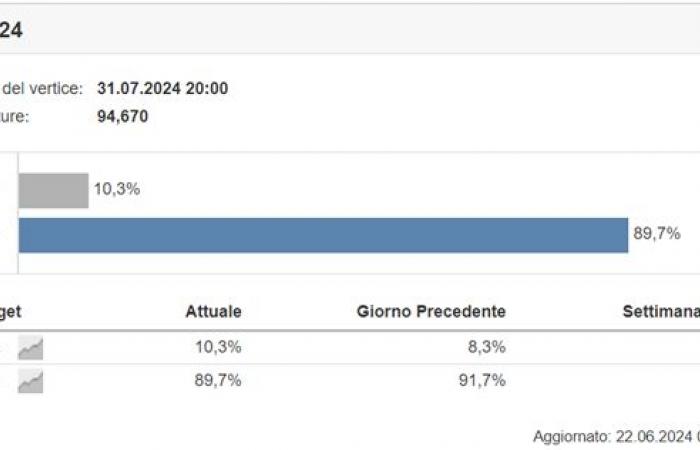

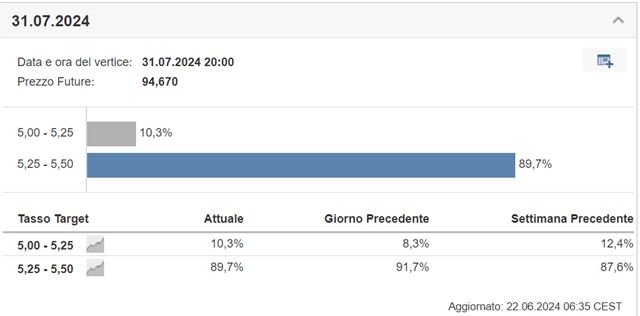

As regards the Federal Reserve’s decision on interest rates, a new consecutive stop is still probable at the next meeting on July 31st. The survey highlighted by our Proprietary toolis equal to 89.7% today, slightly up compared to 87.6% the previous week.

Charts

From a graphical point of view however, the S&P 500 index records new historic highs during the week, despite a slight final retracement, and closes at 5464 points. The main scenario of a favorable summer period remains in place (also considering the seasonality in the last year of the presidential cycle) perhaps until the first half of July, a statistically favorable period, and of a subsequent autumn correction.

A slightly different trend for the European area, where the Euro Stoxx 50 index remains in the 4,900 point area after a slight correction. At the moment it seems that prices have remained within a range of around 200 points (4,900-5,100). Holding during the week will therefore be important (also in light of US data) to attempt a new push towards new highs.

For further information: Investing.com

Do you want to receive FocusRisparmio news every morning? Subscribe to the newsletter!

Register on the site, enter the reserved area and request it by selecting “I want to receive the newsletter” in the “MY SERVICES” section.