On June 18, Bitcoin hit new monthly lows, failing to stay above $67,000.

BTC price weakness causes a return to $64,000

Data from Cointelegraph Markets Pro and TradingView noted the return of BTC volatility during yesterday’s Wall Street trading session.

This produced a trip to local highs at $67,250, but the momentum quickly stalled as sellers took control sending Bitcoin (BTC) to $64,050 a few hours later.

As such, the pair hit its lowest level since May 15, and market observers didn’t find much good news to share.

“As we can see here, the rebound was mainly driven by spot on Coinbase and some buying by Bitfinex”explained popular trader Skew on X.

“ Binance spot is still seeing selling pressure. I think $66K – $67K is the key area to gauge if there is absorption going on, otherwise lower prices will come along with price hemorrhaging.”

However, Skew believes that across-the-board lows, like those seen in recent days, are a behavior “not rare”.

“A good sign is the rather low spot premiums and funding”he added, referring to current exchange funding rates.

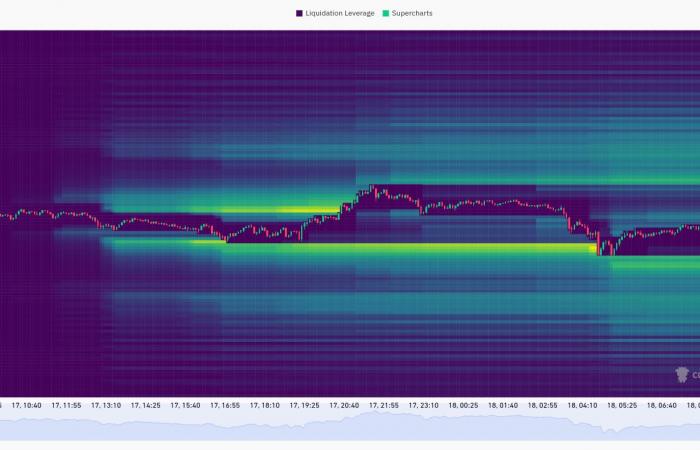

Meanwhile, CoinGlass data shows fluctuating liquidity conditions on BTC pairs after the latest lows.

“Financing rates are slightly positive and showing bullishness. Buy the dip”CoinGlass communicated to subscribers on X earlier today.

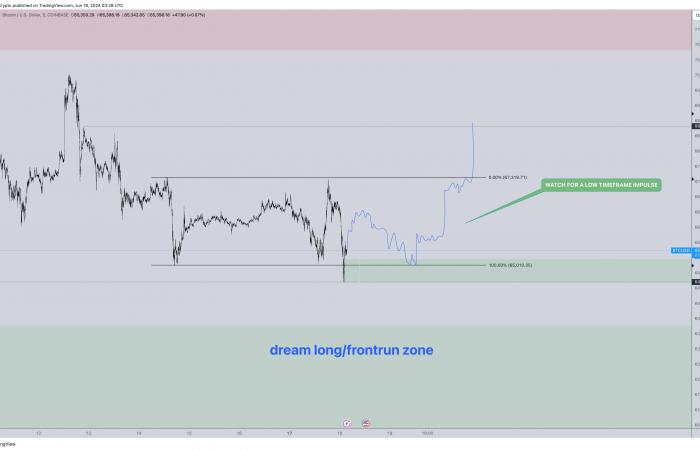

To understand whether the price could drop further, the famous trader Credible Crypto outlined what he called a zone “dreamlike” to go long BTC starting from around $63,500.

However, the chances of this area becoming available for purchase are mixed.

“Yes, technically we can still go into the ‘dream long’ zone down here, but as I said before it wouldn’t surprise me to see that zone run ahead.”reads part of the comment on X, urging followers to “watch for an impulse move on a low timeframe.”

Short-term Bitcoin holders are close to break even

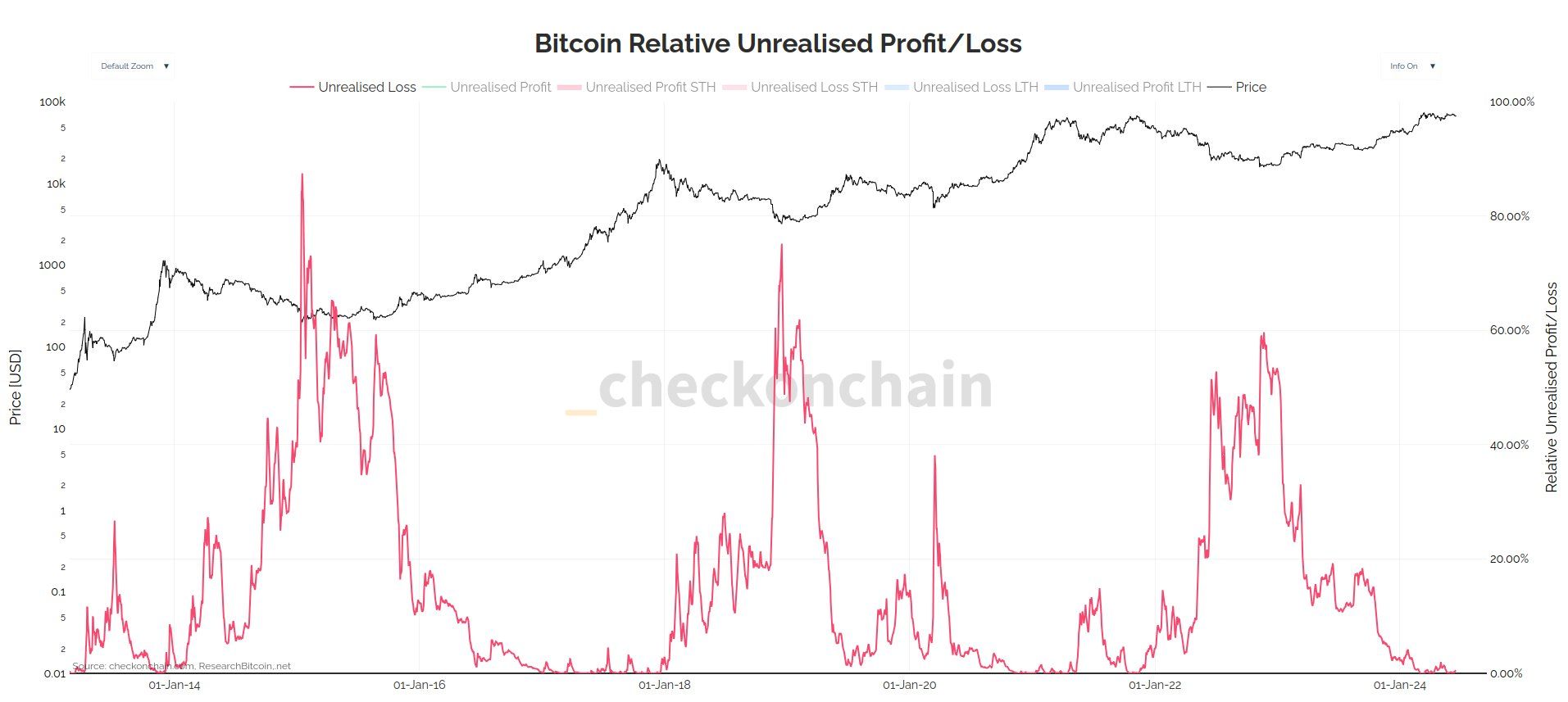

This area coincides with a key bull market support trendline, now under the attention of analysts, including Checkmate, lead on-chain analyst at Glassnode.

Related: Bitcoin Price Crucial at $66,000: 5 Things to Watch This Week

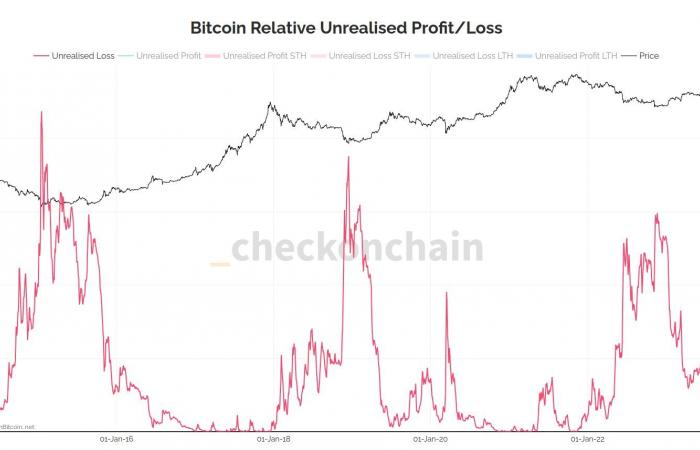

As Cointelegraph reports, the short-term holder realized price (STH-RP), currently at $63,700, has consistently supported BTC’s price action since the bull market began in early 2023.

For Checkmate, the price that preserves this level has driven sentiment.

“It’s hard for me to be too scared of Bitcoin’s price action when the unrealized losses are like this. It could definitely get worse… but it hasn’t yet.”he wrote next to an explanatory graph.

This article does not contain investment advice or recommendations. Every investment and trading operation involves risk and readers should do their own research before making a decision.