THE duties dedicated to Chinese car manufacturers they are almost reality, after a series of investigations and discussions by the European Community and major Western manufacturers. Last September, Ursula von der Leyen announced the launch of an “anti-subsidy investigation into Chinese electric vehicles” and now, months later, it seems that something has actually been planned.

By 4 July 2024, the European Commission will officially announce through the Official Journal theintroduction of a detailed regulation which will define the criteria for determining the amount of duties. Currently, it is mostly speculation regarding the amount of duties and the total number of individuals affected. Numerous details still need to be clarifiedand negotiations between interested parties will enter the crucial phase in the coming days.

Although there is the absence of these crucial aspects, the impact following this decision it seems they are already arriving, what is happening and what can we expect?

How do they work

The European Commission immediately clarified that i duties imposed on electric cars coming from China would have been more specific and targeted than those proposed by the United States. According to the available documents, it is in fact one “personalized” rate which varies depending on the car brand. In the official document issued by Brussels, there is no uniform tariff for all Chinese companies, but different rates that depend on the subsidies received from the Chinese government and the level of cooperation during the anti-dumping investigation launched last October. This system includes duties ranging from 17.4% to 38.1%, depending on each manufacturer’s specific circumstances.

Furthermore, it is important to note that these measures are considered “compensatory”, therefore they are added to the standard 10% tariff already applied on the import of electric cars from any origin. This differentiation in tariffs aims to more precisely reflect the economic and business context of each Chinese company, rather than simply applying uniform tariffs.

Reactions to tariffs

The European Union’s decision to impose targeted tariffs on Chinese electric cars has sparked a lively reaction from China, which called the measures “harmful” and contrary to the principles of the market economy and international trade. China’s Ministry of Commerce rejected the conclusions of the EU, defining them without factual and legal basisand accused the EU of ignoring the fact that China’s competitive advantages in the electric vehicle sector derive from open competition.

On the other hand, theEuropean Automobile Manufacturers Association (ACEA) has welcomed with regret the introduction of duties, reiterating theimportance of free trade and fair to support a globally competitive European automotive industry. ACEA underlined that the healthy competition is essential for innovation and consumer choice, and emphasized the need to ensure a level playing field for all competitors in the industry.

Not all car manufacturers agree to the move

The reactions of the main European car manufacturers were varied: Stellantis reiterated its commitment to free competitionwhile Volkswagen (which clearly depends on the Beijing market) highlighted the risk that tariffs could have negative effects greater than the expected benefits. Ola Kallenius, CEO of Mercedes-Benz, also emphasized theimportance of free global trade and right, saying that increasing trade barriers is not in the interests of exporting nations like Germany.

And exactly recentGermany itself together with Hungary and Sweden have confirmed that they intend to find measures to mitigate the introduction of duties towards Chinese cars.

Which car brands are affected?

As anticipated, the European Union proposal provides for the introduction of additional duties on battery electric cars imported from China, which would be added to the current rate of 10%. These new duties vary based on the Chinese manufacturer, with rates ranging from 17.4% to 38.1%. This implies that some Chinese electric cars sold in Europe could be subject to a total duty up to 48.1%depending on the specific situation of the manufacturer.

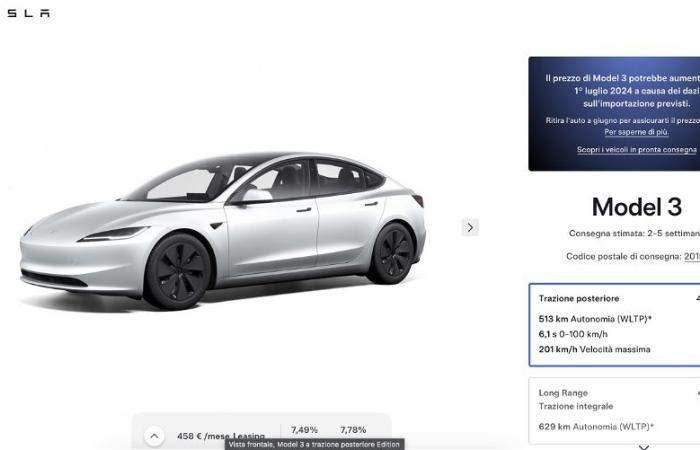

Although at the moment it may seem like a situation still “in progress”, some manufacturers have already expressed themselves widely suggesting a possible adjustment to their price lists. The first is the famous one Tesla which provides a possible increase on Model 3 starting July 1st.

Of a different opinion, however, MG (SAIC group) which has already anticipated in a note that no model or replacement component will suffer a price increase.

How important will the duties be?

BYDone of the most famous Chinese brands in Italy, will suffer a duty of 17.4% which will be reflected in the price of European electricity. The group Geely could suffer a tax 20%; a decidedly salty increase that could affect many models, from the smart to the Volvo EX30also touching Polestar and Lotus.

If Renault implements the tariffs to the letter, the Spring could quickly become less attractive

FAWpresent in Italy with Dongfeng, Forthing and other brands, will receive aadditional tax of 21%; similar discussion for Dacia Spring, the economical electric car is in fact produced in the Chinese Dongfeng factory. On the same wavelength too BMW which, with its joint venture BMW Brillance, could receive a price increase on the iX3 and Mini E, with the latter potentially costing more than a Model 3 if the duties were to be applied to the letter.

While SAIC Motor will not increase prices, at least for now, will receive a 38.1% dutythe tallest of all.

Since when will cars cost more due to duties?

As also anticipated by Tesla on the official configurator page possible that the tax is registered starting from Julybut to date not even this deadline appears so clear.

Furthermore, following the European elections, it is possible that there could be a change of strategy especially following requests from member states and companies operating in the sector.

Possible solutions

The impasse between the European Commission and Chinese manufacturers over tariffs could push for a accelerated movement of Chinese electric car production to Europe. Tesla, for example, could increase Model 3 production at the Berlin Gigafactory to avoid imports from China. Volvoscheduled to begin production of the EX30 in Ghent in 2025, may now be incentivized to speed up the process.

Likewise, BMW is preparing to assemble the new iX3 in Hungary, aiming to make the cars more local to avoid duties. Also BYD is building a new factory in Hungary, while Chery has opted for Spain and Leapmotor for Poland, all moves with the aim of avoiding import duties. Finally, Great Wall Motor and SAIC are actively looking for new production locations in Europe to strengthen their presence on the continental market.

Without a maneuver of this type, the risk is that of being directly affected by Chinese response maneuvers or by our own duties applied by manufacturers, including European ones, to rebalance expenses.