Investing.com – According to the flash PMI estimate, the Eurozone economy suffered a setback in June. For the first time in four months, the volume of new orders fell, causing a slowdown in growth in economic activity and employment. At the same time, confidence fell to its lowest level since February while the rate of inflation of purchasing costs and selling prices fell to their lowest levels in six and eight months respectively.

The slowdown in the expansion of activity in June signals a weakening of growth in the tertiary sector and a more pronounced decline in manufacturing production, with the latter marking the biggest drop in a year. Looking at the Eurozone from a geographic perspective, Germany recorded a slight increase in activity in June, while the rest of the Eurozone continued to indicate strong expansion but at a rate slowed to its lowest level in four months. France, reporting its second consecutive monthly contraction, recorded a less positive result.

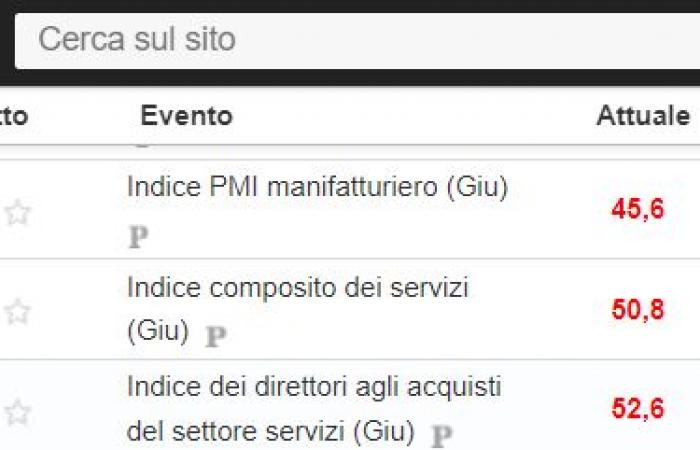

In detail, the composite PMI for production in the Eurozone fell to 50.8 in June from 52.2 in the previous month, reaching its lowest value in 3 months. The data is particularly disappointing given that analysts had expected the index to rise to 52.5.

The result is the synthesis of the decline in the PMI index of tertiary activities, which this month retreated to 52.6 from 53.2 in May (53.5 the consensus) and the decline in manufacturing production: 46.0 in June from 49.3 the month before. At the same time, the manufacturing PMI index fell to its lowest level in 6 months, reaching 45.6, while the markets estimated a growth result of 48.0.

Expectations were for an increase and instead…

“But is the manufacturing recovery over before it even began?” asks Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, commenting on the data of the HCOB PMI index.

“Both we and the markets had anticipated that after the increase in the index in May, we would see another increase in June, which could potentially set the stage for an upward trend. Having said that – continues de la Rubia -, rather than approaching growth, the Eurozone Flash Manufacturing PMI HCOB has fallen, destroying any hope of recovery. This halt was exacerbated by the fact that new orders, which usually serve as a perfect indicator of short-term activity, declined at a far faster rate than in May.” In short, according to the expert, this rapid decline in the flow of orders suggests a recovery that is more distant than initially expected.

Pro Information

SPECIAL OFFER

If you are not yet a subscriber to InvestingPro+, TAKE ADVANTAGE OF THE SALES to do so: you can have access to the FAIR VALUE, the analysts’ TARGET PRICE and all the financial data of over 180,000 listed companies around the world by CLICKING HERE. HURRY, THE SALES WILL NOT LAST FOREVER!

Below are all the instructions to get the discount and maximize profits with your investments…

⚠️ Investing.com kicks off the SALES⚠️

If not now, when? Now you can take advantage of a discount of more than 50% on the 1-year and 1-year Pro+ subscription MAXI DISCOUNT OF OVER 60% on the 2-year PRO+

PRO+ FOR 1 YEAR

CLICK HERE to sign up to PRO+our complete subscription with which you will have:

- Advanced stock screenerwith which you can search for the best titles based on your expectations

- ProPicks: Portfolios of stocks managed by artificial intelligence and capable of beating the market.

- ProTips: Easy, instant information that summarizes thousands of pages of complex financial data in just a few words.

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide an immediate view of the potential and risk of each security.

- Access to over 1,200 key data points

- 10 years of financial data on over 180,000 companies (practically all the stocks in the world!)

- Export data to work offline

- Securities valuation with over 14 proven financial models

- Fundamental charts

- Profit and dividend widget to earn through dividends

⚠️ All of this for about 50 cents a dayit costs you less than half of having a coffee at the bar and opens the doors to all the secrets of the world of investments! (CLICK HERE TO SUBSCRIBE TO PRO+ FOR 1 YEAR) ⚠️

The links in the article and referring to the 1 YEAR PRO+ directly calculate the discount of more than 50% dedicated exclusively to our readers. If the page doesn’t load, enter the code proit2024 to activate the offer.

PRO+ for 2 years at a LOW PRICE!

To get rid of all your worries and save a little more (it costs around 40 cents a day thanks to the MAXI-DISCOUNT OF OVER 60%), there is also the possibility of subscribing to Pro+ for 2 years (Click here to take advantage of the special two-year Pro+ rate). If the page doesn’t load, enter the code pro2it2024 to activate the offer.

So what are you waiting for?!

Act fast and join the investment revolution!

CHOOSE THE PLAN THAT’S RIGHT FOR YOU:

PRO+ 1 YEAR – PRO+ 2 YEARS