According to Annual report 2024 “Regional economies – The Economy of Veneto” from the Bank of Italyintroduced Friday 21 June in the bank’s Verona headquarters in Corso Cavour, the 2023 data the economic activity of the Veneto region has shown signs of weakeningnegatively affected by the slowdown in world trade, high interest rates and the erosion of families’ purchasing power. Despite the resilience of the production and financial system and the recovery of tourism demand, high uncertainty remains linked to the economic prospects and geopolitical tensions.

Macroeconomic framework

According to the quarterly indicator of the regional economy (ITER) developed by the Bank of Italy, in 2023 the regional product grew in real terms by 1.1%, in line with the national figure (0.9%), but significantly slowing down compared to 2022 (4.9%). The Ven-ICE indicator signaled a decrease in economic activity in the second half of 2023, with a recovery in the first three months of 2024.

Business performance

In 2023, regional manufacturing production, after two years of post-pandemic recovery, weakened, recording a decline of 2.0% compared to the average of the previous year. The mechanical sector showed growth, while the food and beverage sector remained stagnant. Other main sectors, such as the fashion system, have seen a reduction in production activity. The turnover of regional industrial companies also contracted.

The prices charged by companies, after two years of strong growth, have slowed down, while industrial investments have reduced, albeit less than expected. Goods exports in volume fell more than potential foreign demand, mainly due to a decline in markets outside the Monetary Union. In the first quarter of 2024, manufacturing production continued to shrink, but at a more moderate pace.

The construction sector has recorded growth thanks to tax incentives for the redevelopment of housing stock and investments from the National Recovery and Resilience Plan (PNRR). The tourism sector has completed the recovery of presences in accommodation facilities, with a significant contribution from foreign travellers.

Despite the economic slowdown, the economic results of Veneto companies in 2023 remained positive. However, the cost of bank debt has increased significantly, influenced by monetary tightening and the high share of the variable rate component. Companies have faced this increase with a more solid financial structure than in the past, thanks to a lower level of debt, greater profitability and availability of liquid reserves.

Loans to businesses decreased, influenced by the increase in interest rates and the still selective credit access conditions.

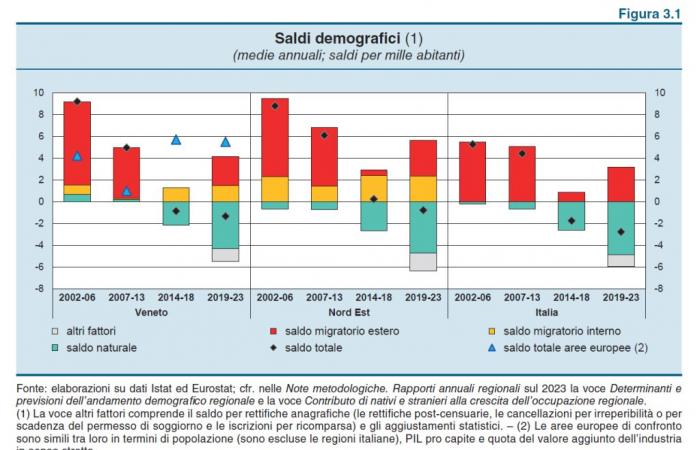

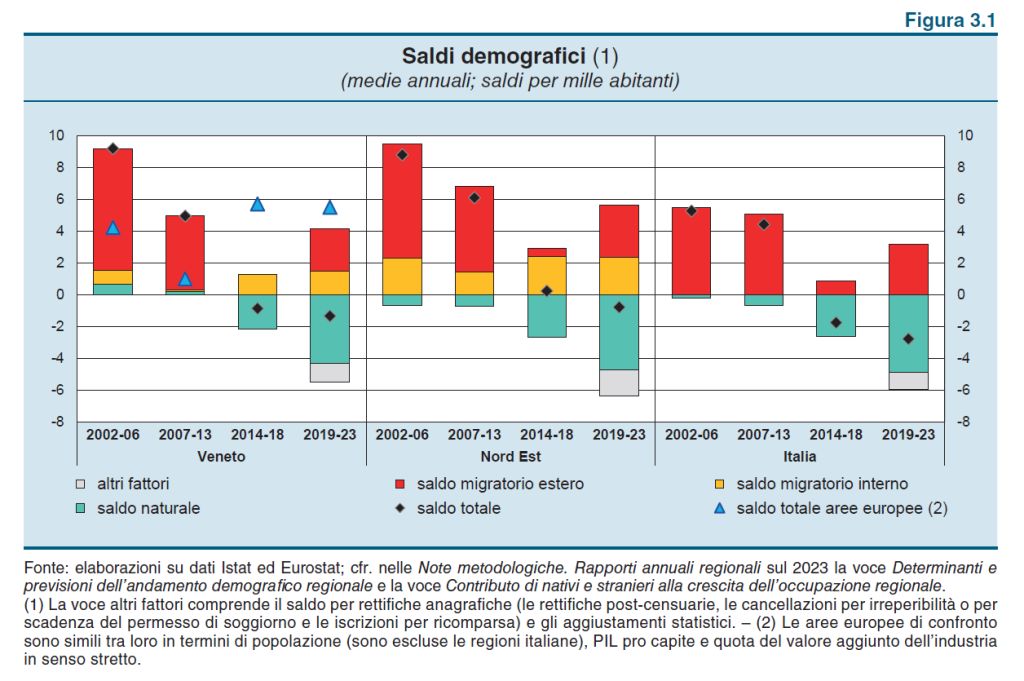

Demographic evolution

Over the last ten years, the population of Veneto has decreased and aged, with significant effects on the job market and economic growth. Unlike other European regions, Veneto has not compensated for this impact with a strong increase in productivity, contributing to the low growth in GDP per capita of the last twenty years. It is crucial to maintain, attract and train specialized human capital and increase female participation in the labor market. Despite a positive balance between entries and exits of graduates to and from other Italian regions, Veneto has a negative balance with foreign countries. The female activity rate is growing, but remains lower than the male one.

Labor market and families

Employment growth continued in 2023, with an increase that affected all sectors, except agriculture, and mainly affected the female component. Inflation, while remaining high, gradually decreased in 2023 and the first months of 2024. The incomes of Veneto families decreased slightly in real terms, while consumption increased slightly.

The increase in the cost of borrowing led to a slight reduction in loans to families, with a decrease in new mortgage disbursements and an increase in consumer credit. The average interest rate on loans for the purchase of homes continued to grow in 2023. Veneto families have revised their preferences for using savings in favor of more profitable instruments.

Credit market

The volume of bank loans to the non-financial private sector fell, with a greater emphasis on those granted to businesses. The quality of bank credit remained satisfactory, with a moderate increase in the rate of deterioration of loans to businesses and stability for those to families.

Decentralized public finance

The Veneto local authorities have maintained a good financial condition, with an increase in spending, in particular capital expenditure, linked to investments in public works financed by the PNRR. Health spending also increased, influenced by growth in personnel spending. However, critical issues arise related to the retirement of numerous professional figures and the need for new staff to ensure the operation of the structures envisaged by the PNRR.