– Advertising –

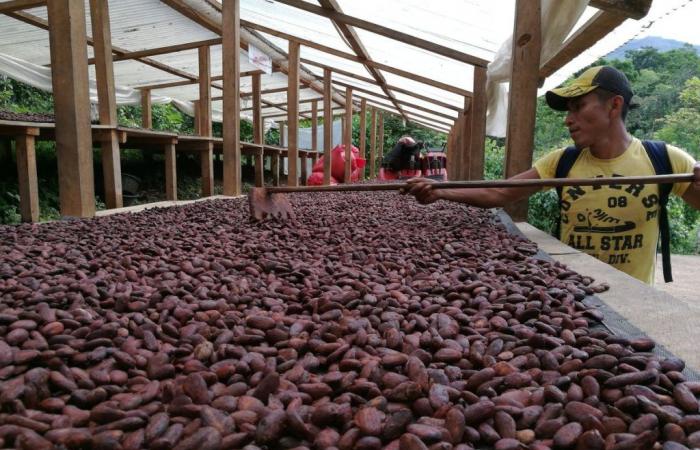

Cocoa prices have more than tripled in the past year, creating major problems for food companies that use the ingredient to make chocolate. The price of cocoa in recent years has been around $2,500 per ton.

Due to a weaker than expected harvest, an upward spiral has been triggered in recent months in cocoa prices which have more than quadrupled, reaching an all-time high of over 11,000 dollars per ton in April.

Since then, the price surge has eased somewhat, but the price of cocoa is still well above what food companies are used to paying. West Africa, which produces the majority of the world’s cocoa supply, has been hit by crop diseases and a weather situation that has created significant delays in logistics, negatively impacting expected deliveries.

Furthermore, farmers are paid too low prices, which pushes them to grow more profitable crops such as rubber instead of cocoa.

It now seems clear that this season’s cocoa crop will record the largest deficit in six decades. In recent days there has also been news that Ghana, the second largest cocoa producer, is trying to delay the delivery of up to 350,000 tonnes of beans for next season, causing prices to rise again.

The Increase in Cocoa Prices Puts Chocolate Producers in Difficulty

For now, many of the largest candy companies – Hershey, M&M’s maker Mars, Kinder owner Ferrero, and Cadbury parent Mondelez – have been at least partially protected from rising cocoa costs, thanks to contracts long-term ones that lock in the prices they pay for raw materials.

However, if prices do not fall dramatically in the coming months, as early as 2025, confectionery companies will end up paying much more for their cocoa.

In recent earnings calls, Mondelez and Hershey executives said they believe market speculation is at least partly driving cocoa’s surge.

Prices may drop in September once more information about the new crop becomes available, but that doesn’t mean they will return to normal. The rising cost of this raw material comes at a difficult time for many food companies.

Over the past two years, many have raised prices to address inflation that has touched a broader range of commodities. As a result, shoppers have become more selective about what they buy and increasingly dissatisfied with the prices they see in grocery stores.

As has happened in the past, manufacturers of chocolate-based confectionery could resort to so-called “inflation restraint”, a practice in which companies tend to reduce the quantity or weight of a product, leaving the price unchanged. But consumers have become aware of the trick.

A Historical Example: The Creation of Gianduia

During the period of economic blockade ordered by Napoleon Bonaparte established in the Berlin decree of 21 November 1806, which intended to affect the products of British industry and its colonies, cocoa prices skyrocketed because the blockade had made it difficult to obtain of cocoa.

In this period, all-Italian genius led to the creation of the gianduia. In fact, as early as 1806, Turin pastry chefs began to replace part of the now very expensive cocoa with the cheaper paste derived from the round gentle hazelnut from the Langhe.

The new product was successful and years later, in 1852, the chocolatier Michel Prochet, in partnership with Caffaril, improved the mixture by toasting the hazelnuts and grinding them finely. The gianduiotto was born from this soft mixture, which took its name from the popular mask of Turin, which presented it as the first wrapped chocolate on the occasion of the 1865 Carnival.

In addition to the preparation of gianduiotti, gianduia chocolate is also enjoyed in bars, in cups, in spreadable cream (Nutella is a famous variant), as a filling for other confectionery preparations. Over the years, all the great Turin chocolatiers – De Coster, Domori, Baratti & Milano, Caffaril, Gobino, Novi, Pernigotti, Peyrano, Guido Castagna, G. Pfatisch, Streglio, Stratta, Venchi, Feletti – have dosed the simple ingredients in their very personal formulas.

Our Advice

As cocoa prices rise, it’s important for consumers and investors to closely monitor the moves of large chocolate companies. Here are some tips for navigating this situation:

- Diversification: Investing in a diversified portfolio of food companies that are not overly dependent on cocoa can mitigate risks.

- Product Innovation: Companies should explore alternatives and innovations in their products to address rising costs.

- Professional Consulting: Consult financial experts for advice on how to adjust investment strategies based on fluctuations in commodity prices.

That’s why we are here…

Flavio Ferrara – Independent Financial Advisoris here to help people invest consciously, starting from what we know we don’t know and using simple, calm and engaging language.

In-depth analysis

The China-US Trade and Diplomatic War: Possible Recession and the Gold Opportunity

– Advertising –