The signs of a slowdown in luxury are materializing and are coming from the East. New data from the Federation of the Swiss Watch Industry shows that the luxury watch exports suffered the largest decline since 2020, due to the collapse in demand in Asia.

Swiss watch exports fell in March. Their value dropped by 16.1% compared to the same month in 2023, reaching 2 billion Swiss francs (2.2 billion dollars). Collapse in demand in China and Hong Kong caused most of the decline. Weakness was recorded in all six major markets.

Exports to mainland China, the second largest market for Swiss watches, sfell by 42%, the worst decline since March 2020, when the global economy began to stall due to government-imposed lockdowns. Shipments to Hong Kong plummeted even further, down 44%.

“The negative trend is even worse than we expected and the decline in China is really worrying and probably indicates that inventories in the region were once again too high,” Jean-Philippe Bertschy, an analyst at Vontobel in Switzerland, told Bloomberg.

Stocks are high because evidently not enough is being sold. Watches are the classic product of the wealthy middle class which, evidently, no longer exists.

The drop in demand for Swiss watches comes a day after LVMH Moët Hennessy Louis Vuitton, the world’s largest luxury group, controlled by the family of billionaire Bernard Arnault, reported that “uncertainty in the geopolitical and economic context” weighed on luxury spending.

LVMH shares in Paris are 10.5% below the peak reached early last year. Even this last month the trend was not positive:

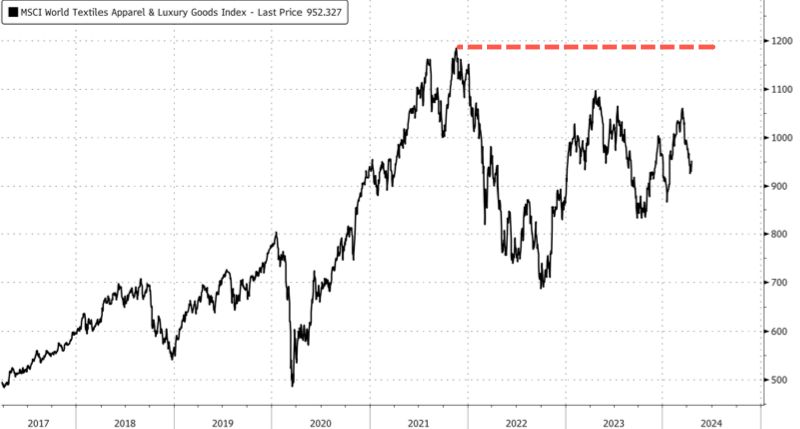

For a broader view of global luxury stocks, the MSCI World Textiles, Apparel & Luxury Goods Index also shows the index well below (-21%) the peak reached at the end of 2021.

The combination of a slower-than-expected Chinese economic recovery and generation-high interest rates across the Western world are some of the reasons why a global slowdown in the luxury market has materialized. Furthermore, evidently, growth in the USA is not such as to have favored a diffusion of wealth and a greater market base. The fewer people have money to buy luxury goods, the fewer they buy.

Furthermore, we also consider that the high price of gold may have attracted the exclusively speculative part that previously also turned towards luxury collectible goods, such as watches, drying it up.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

⇒ Sign up right away ⇐

Tags: Swiss watches longer sold Asia Luxury languishing displaced crises gold