From credit card fraud to social media phishing, Gen Z and Millennials are at greater risk of falling victim to scams The phenomenon of online scams continues to grow. Despite being digitally native generations, surprisingly, those who are most likely to be victims of these phenomena, from credit card fraud to phishing, are Gen Z and Millennials and not seniors. This is what emerges from the evidence of the State Police and Airbnb who, on the eve of summer and holiday bookings, have renewed their collaboration to help citizens recognize and avoid bad guys online.

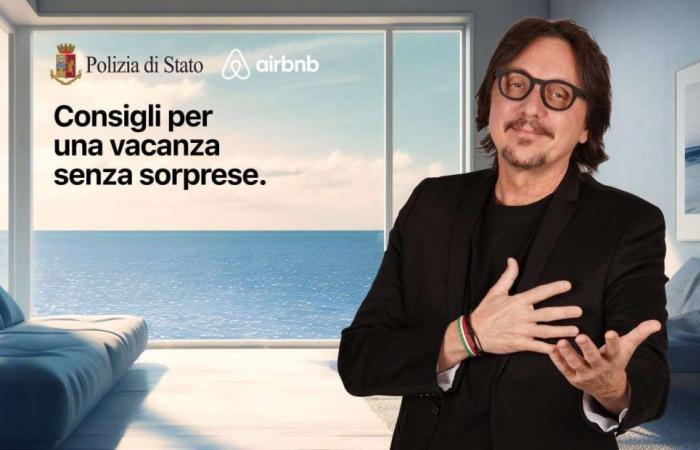

The testimonial of the campaign is Marco Camisani Calzolari, who already collaborates with the State Police on the topic of online scams. The identikit of the victim According to the 2023 Report of the activities of the Postal Police and Cyber Security, last year there was a considerable increase in online scam attempts in Italy, with a growth of these crimes of 6% from 2022 to 2023 and a consequent increase in the money stolen, which went from 114 million euros to 137 million (+20%).[1] Instead, 2,500 phishing sites have been identified and blocked by Airbnb in the last 12 months alone. Even though they were born and raised in the digital age, the new generations are less careful when it comes to online security. According to Consumerismo, 1 in 5 Italians declares having been the victim of at least one scam while shopping online, a percentage that rises to 33.1% in the 25-34 age group: this means that 1 in 3 young people have fallen into the “traps” of e-commerce.

Italy is no exception compared to Europe, as Airbnb’s research highlights:

● In the UK, 18-34 year olds have been scammed more than any other age group and more than a third (34%) would not know where to turn for help if they were scammed.

● In Spain, most Baby Boomers (60%), Gen X (55%) and Millennials (56%) use a different password for each online account, while the percentage drops to half (50%) when considering Gen Z.

● In the Netherlands, almost a third of 18-24 year olds (31%) and 25-34 year olds (33%) are willing to pay for their holidays with a bank transfer, a less secure payment method, compared to just 14% of 55-64 year olds and 14% of over 65s.

● In France, nearly a quarter (23%) of users would use a social network to pay for or book holiday accommodation, a context in which scammers could target victims with offers too good to be true.[5] While Baby Boomers are generally thought to be the most at risk of being scammed, Millennials are actually more likely to make impulse purchases if they can save money; they are more likely to make deals outside of trusted booking platforms, which puts them at greater risk of something going wrong.

Finally, the relaxed attitude towards social media that is used every day can be among the causes that expose young people to unpleasant surprises. Valentina Reino, Institutional Relations Manager of Airbnb Italia, declared: “We are in the middle of the booking period; this initiative aims to help people understand what warning signs to look for and good practices to adopt.

When it comes to booking on Airbnb, we encourage our guests to communicate, book and pay only on the platform, where transactions are secure and can also count on AirCover, our insurance program to protect hosts and guests. In fact, the vast majority of scams occur outside our site”.

“In recent years there has been a constant increase in the sector of financial crimes committed online, in 2023 alone the Postal Police dealt with over 16 thousand cases, including those linked to the booking of holiday homes, packages and travel tickets. Although the majority of scams occur outside of travel booking platforms, we also find significant evidence in this sector, especially during peak holiday planning periods. These are types of scams which, with adequate and constant awareness-raising among users, can be recognized and avoided, and the Postal Police is fully committed in this direction. For this reason, we appreciate and renew our collaboration with Airbnb in preventing such crimes.”

Massimo Bruno, First Director of the State Police and Director of the Financial Cybercrime Division of the Postal Police and Cyber Security Service. How to avoid online scams: advice

1. Check the website address. Whether you use a computer or a smartphone, it is best to verify that you are booking through the official platform. The solution is to use the Airbnb app or go directly to the website to make sure you are on the official site (www.airbnb.it).

2. Don’t click on unknown links. Lax use of social media can contribute to exposing users to the risk of scams. If you are not sure whether a message or post is from a legitimate company, do not share or interact with it, and do not click on any links. Airbnb provides guidelines on how to identify a genuine link or email from the platform.

3. Be wary of offers that are too convenient or requests for a deposit. With the cost of living rising, many consumers are on the hunt for great deals; but if an offer or advert seems too good to be true, we may be dealing with a scam. In this case it is advisable to take all the time necessary to examine the details of the advert and the existing reviews, especially if you are in a hurry to pay.

4. Never pay by bank transfer. This is a payment instrument not permitted by Airbnb. Better to use a credit card, which offers more protection. If you receive a request to pay for a trip via bank transfer, cryptocurrency or gift cards, it is very likely a scam.

5. Book, pay and communicate only on the platform. Some users may be attracted by the proposal to negotiate privately outside the portal to save money. However, this does not allow you to take advantage of Airbnb guarantees, which does not recognize payments made by guests until 24 hours after check-in, while AirCover for guests provides protection for some possible eventualities.

6. Check reviews. Reading other guests’ opinions is useful to get a better idea before booking, by checking the ratings and reviews and carefully reading the listing description. You can also ask the host questions via messaging on the platform before blocking your dates.

7. Communicate with the host. Once you have booked, before you travel, it is best to contact the host to make arrangements for your arrival and to check for any particularly important needs. If you do not receive a response, contact customer service immediately.

8. How to report a concern in the right way. On Airbnb, users can report controversial messages directly from internal messaging, while suspicious cases can be reported via a flag on each listing. If you have made a payment off-site, you must immediately contact customer support who is available 24 hours a day, 7 days a week.

Happy holidays from the State Police and AirBnB!