Between operational delays, doubts and questions still open, the date scheduled for the departure of agreed biennial budget 2024 is scheduled for tomorrow, June 15th.

Based on the data in its possession, theRevenue Agency will prepare a proposal for you VAT numbers that apply ISAs, synthetic indices of fiscal reliabilityand for those in flat rate regime to block the payment of taxes for two years, in the first case, and for one year, in the second.

For the Government it represents the great hope of making moneythe hypothesis (without, however, data) is that come on Tax-taxpayer agreements resources can be recovered to confirm the three IRPEF rates but also to move forward on the path of flattening taxation.

The success of the 2024 preventive agreementHowever, it is all in the hands of taxpayers and the choices they will make and it is difficult to make estimates. How many VAT numbers will accept the agreement proposed by the Revenue Agency?

A word from readers: response to the survey in the box below and comments via email to the editorial staff by writing an email to the address [email protected] with subject: “agreed”.

Agreement with the Revenue Agency on the payment of taxes

Are you thinking of joining?

Composition with creditors 2024: difficult start for the agreement between VAT numbers and the Revenue Agency

There are few certainties about the outcome of the two-year preventive agreement for now. And if on the one hand the Government has high expectations on possible agreements between VAT numbers and theRevenue Agencyon the other hand the organizational machine, necessary to lay the foundations for success, is struggling to get into gear.

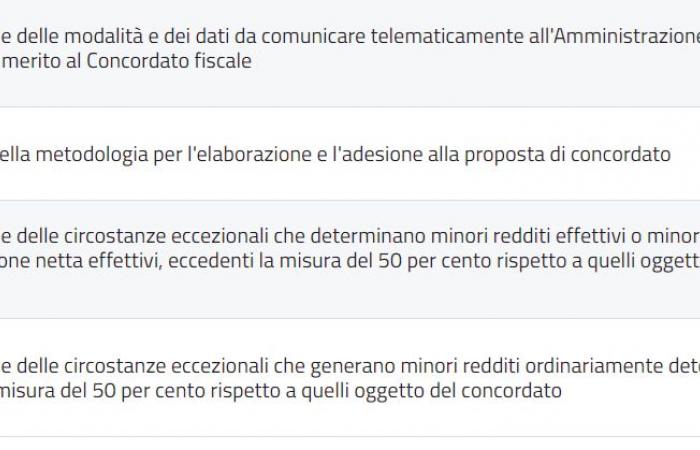

As of today, June 14th, Three out of four implementation measures are still missing to outline the framework of rules on which the relationship between tax authorities and VAT numbers will have to be based.

The text on definition of the methodology for the preparation and adhesion to the proposed agreementon which the Privacy Guarantor was called to express his opinion, would be in the home stretchin conjunction with or even after the watershed date of June 15th for sending the data useful for developing the proposal.

But not only that: they should arrive during construction, in the Council of Ministers on 20 June, some corrections on the rules and times to be respectedthere is already talk of an extension of the membership deadline which should pass from 15 to 31 October 2024.

In short, the engines of the agreed biennial budget but we don’t know for sure what the route will be.

Concordato 2024: how many VAT numbers will join the agreement with the Revenue Agency?

The agreement between the Revenue Agency and VAT numbers was born for “smaller taxpayers who are holders of business income and self-employment deriving from the exercise of arts and professions resident in the territory of the State”we read in dossier drawn up by the Chamber on the legislative decree number 13 of 2024 which establishes it, “for the express purpose of rationalizing declarative obligations and encouraging spontaneous compliance”.

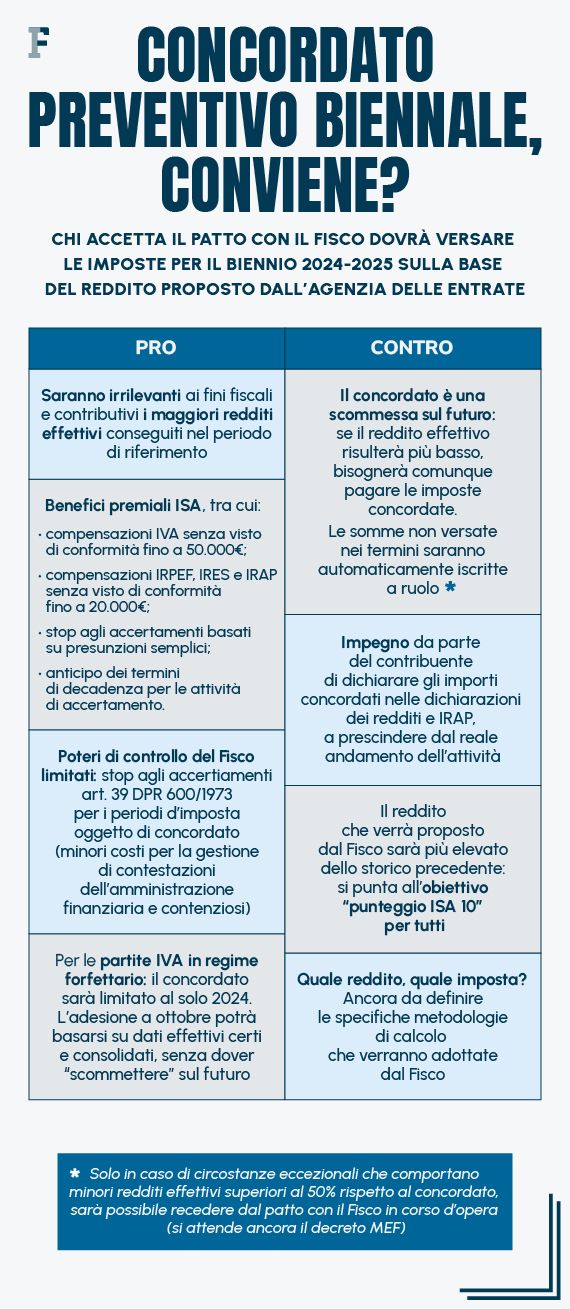

But together with advantages for those who join there are also a series of risks which could affect the choice of VAT numbers interested.

The changes in income they do not enter into the calculation of the taxes to be paid and this is the great novelty of the agreement. But if the additional income will not be taxed, on the contrary any losses they will not reduce the taxes to be paid.

The pact only lapses “in the presence of exceptional circumstances, identified by decree of the Minister of Economy and Finance, which determine lower actual incomes or lower actual net production values, exceeding 50 percent compared to those covered by the agreement”.

As also reiterated in the press conference of 30 July by Deputy Minister of Economy and Finance Maurizio Leothe success of the agreement depends on consolidation of the three IRPEF ratescurrently scheduled only for 2024, and the possibility to go further.

But on the eve of the debut of the accession procedures, What do the VAT numbers directly involved think about it?

The word passes to the readers of Tax Information: the invitation is to participate in the survey on the topic by clicking on “take part in the survey” in the box available at the top of the article and to elaborate on the answer with comments, reasons and considerations by sending an email with the subject “Agreed” at the address [email protected].