June 26, 2024 3:28 pm CEST

| 4 min read

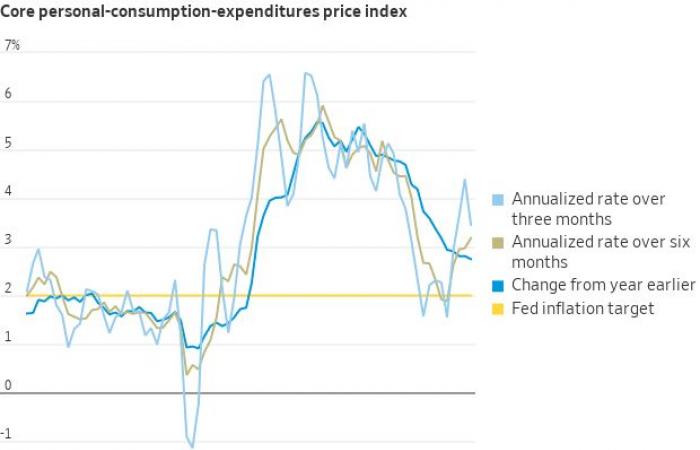

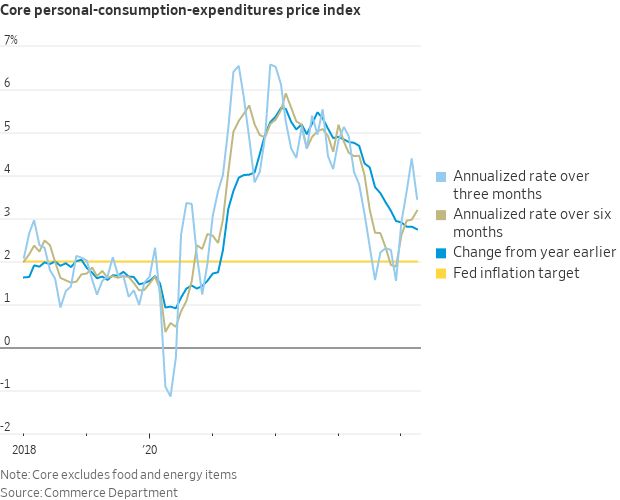

Today Bitcoin (BTC) continued its upward run reaching $67,900. The price index Core PCE, the Federal Reserve’s preferred measure of inflation, rose 0.2% month over month in April, in line with expectations but slightly below the previous month’s 0.3% increase. This modest increase could ease the Fed’s inflation concerns, but larger declines are needed to support a potential rate cut by September.

Chicago’s PMI instead fell to 35.4, below the expected 41.1, indicating weakening manufacturing activity. This data suggests a complex economic outlook, with declining inflation but slowing economic activity, and therefore a bullish outlook for the price of Bitcoin.

US inflation data and potential Fed rate cut

As we said at the beginning, Bitcoin (BTC) has maintained its momentum rising to approximately $67,900 largely thanks to the Core PCE price index, which rose 0.2% month-on-month in April, meeting expectations. This slight increase could ease the Fed’s inflation concerns, but further reading is needed to predict a rate cut by September.

- Core PCE Price Index m/m: 0.2% (expected 0.3%)

- Chicago PMI: 35.4 (previous 37.9)

The Chicago PMI fell to 35.4, below expectations of 41.1, indicating a weakening of manufacturing activity. This data suggests a mixed economic outlook, with inflation showing signs of easing as economic activity slows.

The data has an impact on the price of Bitcoin as the potential Fed rate cut by September becomes more likely if inflation continues to decline, which could weaken the US dollar and support BTC price gains.

Disappointing US GDP data supports Bitcoin price

The rise in BTC price is largely due to the weakening of the US dollar, which lost traction following the disappointing US GDP data. This has led traders to predict a Federal Reserve rate cut this year, putting pressure on the dollar and benefiting BTC.

Key points:

- Chicago Fed President Austan Goolsbee highlighted concerns about housing inflation and the robust job market.

- Atlanta Fed President Raphael Bostic suggested that a rate cut in July is unlikely due to slow progress in inflation.

- New York Fed President John Williams is optimistic that inflation will ease this year.

- US economic data revealed that GDP grew at an annualized rate of 1.3% in Q1, down from the previous 1.6% but in line with expectations.

Additionally, weekly US unemployment claims rose slightly to 219,000, beating market forecasts (218,000). These factors, combined with the expectation of a Fed rate cut, have strengthened Bitcoin’s appeal.

Bitcoin price volatility influenced by BTC ETFs

The Bitcoin Spot ETF market also showed mixed signals from investors, with total investments amounting to $48.71 million.

In particular, iShares by Blackrock recorded a modest inflow of $2 million, while Fidelity saw a significant inflow of $119 million, underscoring strong investor confidence. Also Bitwise attracted $26 million, indicating growing confidence in its offerings.

Key points:

- iShares by Blackrock: inflow of $2 million

- Fidelity: raised $119 million

- Bitwise: influx of 26 million dollars

- ArkShares: withdrawal of 100 million dollars

- I invest: inflow of $2 million

However, ArkShares faced a sizeable $100 million withdrawal, suggesting a potential shift in investor sentiment. Invesco maintained steady interest with an inflow of $2 million.

Meanwhile, WisdomTree, Grayscale, Franklin, Valkyrie and VanEck saw no new investments, likely due to competitive pressures and evolving investor preferences.

These mixed investment flows in the Bitcoin Spot ETF market signal mixed sentiment among investors, which could lead to increased BTC price volatility. Strong inflows increase market confidence, while significant withdrawals create uncertainty, affecting Bitcoin’s price dynamics.

Technical Outlook for Bitcoin (BTC/USD): June 1, 2024

Bitcoin (BTC/USD) is currently trading at around $67,900, marking a slight increase of around 0.25%.

The pivot point, marked in green, is set at $68,100 and serves as a critical indicator for the potential direction of the market. Immediate resistance levels are positioned at $68,800, $69,800 and $70,600.

On the downside, immediate support lies at $67,500, with further support at $66,600 and $65,900.

Technical indicators show therelative strength index (RSI) at 46.94, suggesting neutral or bearish sentiment.

Furthermore, the exponential moving average The 50-day EMA is aligned with the pivot point at $68,100, indicating this level as significant dynamic support.

The outlook for Bitcoin remains bearish below the $68,100 pivot point. A break below the immediate support at $67,500 could lead to further declines, while a break above $68,800 could move the sentiment towards an uptrend, targeting higher resistance levels.