Commercial real estate transaction signings in Europe fell to a 13-year low in early 2024, as high interest rates made mortgages expensive and therefore made investments in these types of properties less attractive, data reported from the FT.

Transaction volume of 34.5 billion euros in the first quarter was 26 percent lower than already depressed levels in the same period last year, the seventh consecutive quarter of declines, according to MSCI data released Thursday . The number of office buildings that changed hands was lower than in any other quarter.

The commercial real estate market has undergone a brutal adjustment to much higher interest rates, which have hit property values and increased financing costs in a market that relies heavily on debt to finance operations.

“After a very slow 2023, it was hoped that European real estate investment would start to recover in the first quarter of 2024,” said Tom Leahy, head of EMEA real estate asset research at MSCI.

“But the ongoing and sometimes painful readjustment to the end of historically low interest rates means the market remains a difficult place to trade.”

The report followed US data last week, which showed a 16% decline in transaction volume in the first quarter compared to a year earlier.

The values of European offices they fell by an average of 37 percent compared to the peak reached in 2022, according to Green Street research. Residential and industrial property prices fell by around a fifth.

While some owners have been forced to sell due to debt pressures, others are reluctant to crystallize losses at what they believe may be the bottom of the market.

The most affected cities

London was “by far” the number one city for investment, MSCI said, despite falling transaction volumes. A faster price correction in the UK, compared to the rest of Europe, has encouraged investors to return to the market in search of bargains.

Two high-profile deals in the office sector – the sale of 20 Old Bailey for £240m and a £110m deal brokered by insolvency practitioners to sell 5 Churchill Place in Canary Wharf – collapsed during the quarter. However, this was read by some market participants as a sign that sellers hope they can wait for better prices after the Bank of England lowers borrowing costs.

Paris, on the other hand, was a disaster, with a 64% drop in commercial real estate sales in the first quarter of 2024, a figure that suggests a powerful reduction in prices. Those who cannot resist will be forced to get rid of their properties with significant losses.

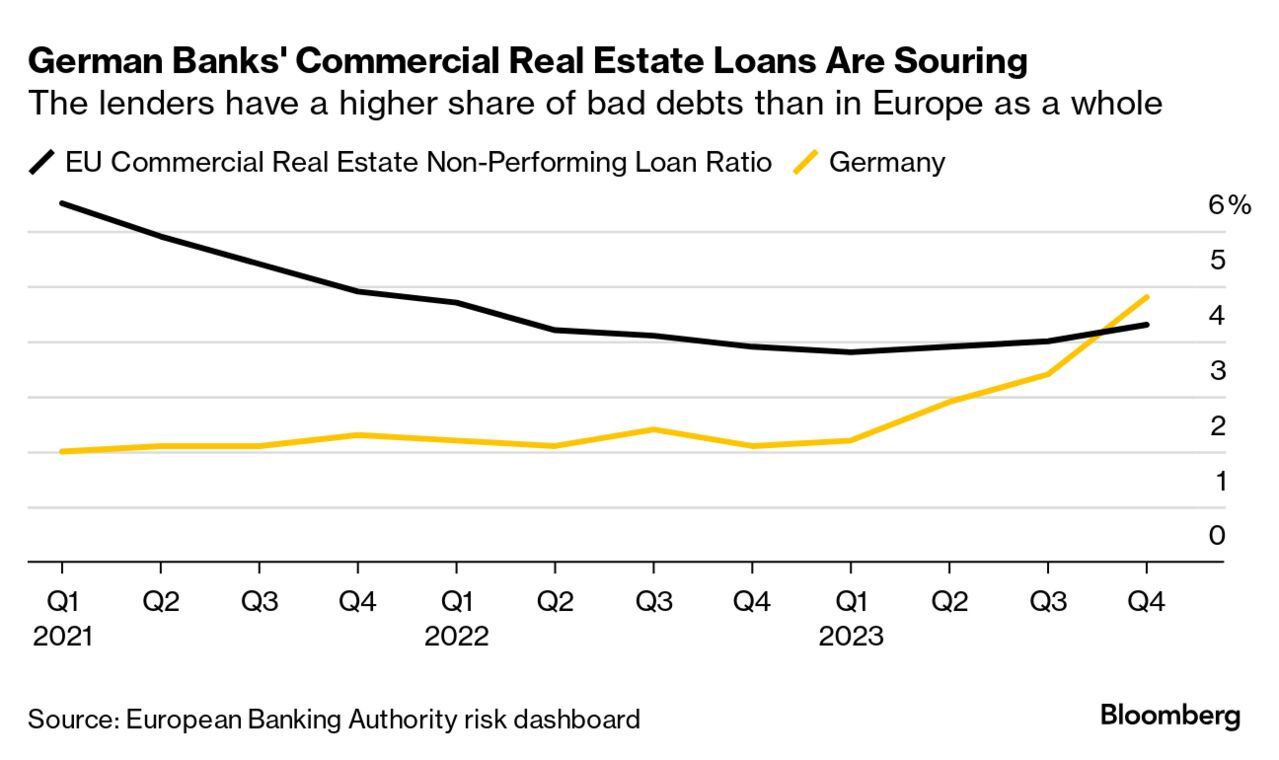

In Germany, 2023 saw a 10% drop in prices.

In 2024 there are slight signs of a rebound, but the situation still remains difficult and there will certainly be consequences for the German credit system, a factor already highlighted by the Signa group crisis.

The crisis has just begun and the new requests linked to green efficiency will not reduce the price of properties.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

⇒ Sign up right away ⇐