There political crisis in Francetriggered by the disappointing outcome of the European elections for Emmanuel Macronhe folded Business Square which last Friday lost 2.8% together with the banks, hammered by the spread.

The differential between the ten-year BTP and the corresponding German Bund has in fact exceeded 155 basis points. A poison for the Ministry of Economy, which will find itself having to pay more interest to finance the public debt, but also for the banks that have piled up in their balance sheets Bots and BTPs.

Because, to put it extremely simply, if bonds with a more generous yield are about to come into circulation, those previously issued will appear less attractive to investors.

Last Friday Unicredit thus lost 5.5% on the stock market, making it the worst stock on the Ftse Mib index. However, it also went decidedly badly for Bper and Monte Paschi (-3.5%), Banco Bpm (-2.8%) and Intesa Sanpaolo (-2.5%) and in general for the entire financial sector.

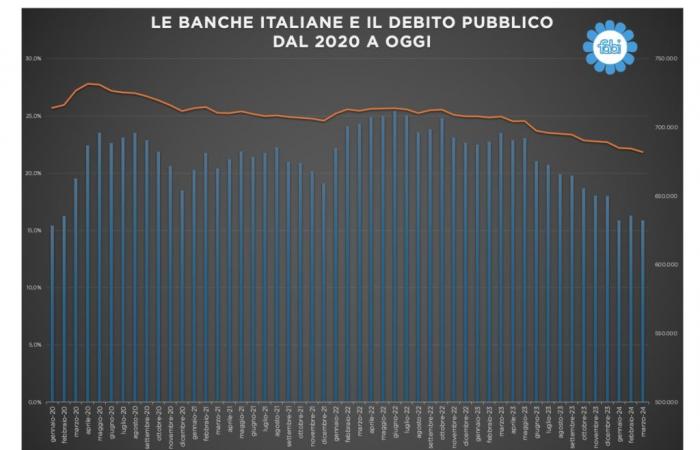

What will happen on Monday when the markets reopen? How will Piazza Affari and the BTPs fare? The phase of instability is likely to continue. However, it is worth keeping in mind that if on the one hand in the last four years the mass of BOTs and BTPs held by Italian banks has remained almost unchanged, their overall exposure to Italian debt has reduced.

Precisely just before the start of Covid, in January 2019, the public debt in the hands of the banks was 628 billion, equal to 25.7% of the total and now it is equal to 632 billion, but equal to only 22 percent. Almost four basis points less.

The measures are taken by a study by Fabi, the main banking union, noting that the highest peak, in absolute terms, was reached in June 2022 when there were more than 712 billion Bots and BTPs in the banks’ portfolios.

Among the factors that favored the decline there is also the Treasury’s choice to secure the Italian public debt in the pockets of families with repeated issues of the BTP Valore: all concluded with a full collection thanks to the generous dividends assured to subscribers and the loyalty bonus reserved for “drawer holders” who will keep them until they expire.

In summary, the fact that the Treasury is less dependent on the changing moods of foreign institutional investors and on the algorithms that now command purchases and sales on their stock exchange terminals, should offer partial shelter to our money invested in the stock market.

However, the market’s nerves remain on edge and therefore the probability of further shocks appearing appears very high. What matters, as mentioned, is the climate of instability that has been created in Europe after the European polls.

Especially in France which in less than three weeks is forced to call citizens to vote to choose who to govern after Macron. Not to mention that the majority of German Chancellor Olaf Scholz also emerged with half-broken bones.

Read also: Gold fever remains high, how to choose between gold ETFs, ingots and pounds.

And the financial markets, analysts explain, prevent the danger of the French and German “witch” by selling the government bonds of the most indebted countries. Just like Italy, even if the Meloni government as a whole emerged strengthened from the electoral test in Brussels.

The priority for our country therefore remains that of reducing the burden of public debt. Especially after the ECB’s decision to block the path of lowering interest rates it has just started, and the US Fed’s choice not to even start it.

Did you like this article? Read also

Follow us on our channels