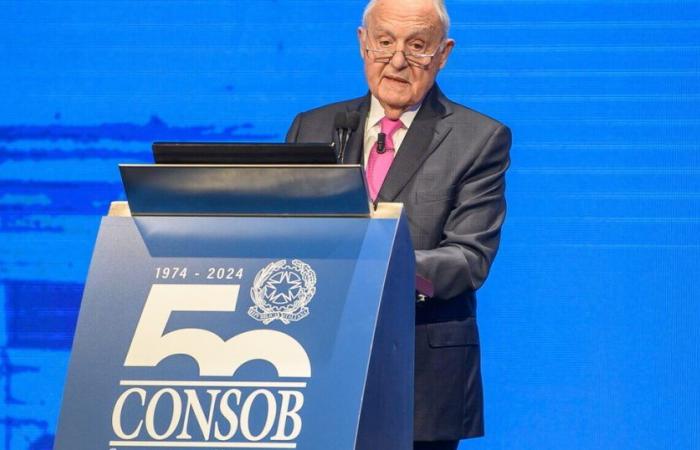

In recent years, many have turned up their noses at the growing attention paid to topic of cryptocurrencies and cryptoassets in the annual reports to the market of the President of Consob. Purists would have preferred that the authority of regulated financial markets be limited to the “traditional” financial market in Europe in our country. In the report illustrated yesterday by Professor Paolo Savona, the reflection of years has however arrived at an explicit indication of the consequences that should be drawn from it. A proposal that will perhaps make traditionalists raise their eyebrows again. But which is anchored in solid reasoning, given that Savona holds firm to two fundamental beliefs, widely shared by monetary and savings theory.

In recent years, many have turned up their noses at the growing attention paid to topic of cryptocurrencies and cryptoassets in the annual market reports of the president of Consob. Purists would have preferred that the authority of regulated financial markets be limited to the “traditional” financial market in Europe in our country. In the report illustrated yesterday by Professor Paolo Savona, the reflection of years has however arrived at an explicit indication of the consequences that should be drawn from it. A proposal that will perhaps make traditionalists raise their eyebrows again. But which is anchored in solid reasoning, given that Savona holds firm to two fundamental beliefs, widely shared by monetary and savings theory.

Since the market increasingly believes in totally dematerialized payment, savings and investment assets based on shared platforms on a private and contractual basis, and on decentralized registers not subject to the supervision of traditional regulators, assets on which the banks themselves have ultimately decided to operate, then at the very least, the public sector should monitor not only the safety of the “ledgers”, the decentralized accounting registers, but also address the lack of a debt counterparty, which exposes investors and savers to very strong risks of losses.

On the other hand, however, we cannot ignore the tumultuous developments that Artificial Intelligence also proposes for blockchain technologies. And in view of the adoption of digital fiat money by the ECB and central banks, we might as well clearly indicate that the best objective is to separate the supervision of money, which must remain in all its forms in the hands of the central banks , from the supervision of every savings and investment asset, whether real or virtual and starting with the bank deposits themselves: all these activities must fall under the sole supervision of the financial regulator. Which would allow break the historic chain which, by combining monetary regulation and banking supervision, has ended up placing financial stability before monetary stability in the work of central banks.

Such a regulatory architecture has the advantage of better preserving the public supervisory functions by separating them, and of taking seriously what the enormous technological development produces on the very foundations of the “old” monetary and investment thinking.