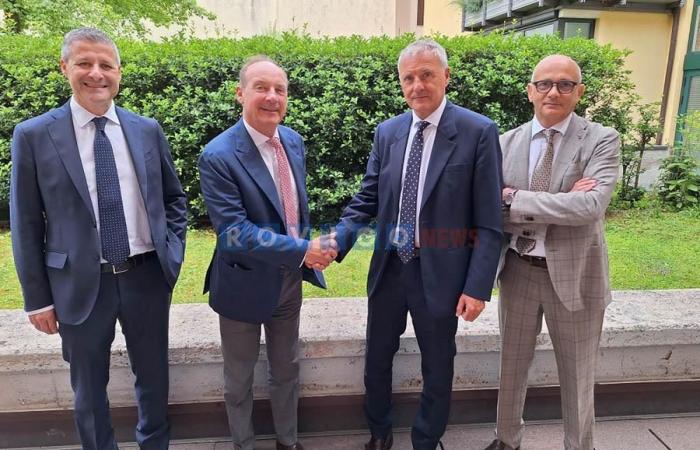

THIENE (Vicenza) – The deed of merger between BVR Banca and Banca del Veneto Centrale was signed on Thursday 20 June by the presidents Gaetano Marangoni and Maurizio Salomoni Rigon, at the office of the notary Stefano Lorettu in Thiene.

This is the formal act that accepts the outcome expressed by the two extraordinary meetings both held at the Congress Center of the Vicenza Fair, respectively last 18 and 19 May 2024, during which the members of the two Cooperative Credit Banks expressed their their decisive consent to the aggregation project with broad support.

The agreement therefore represents the final act of a process that began last October 10th with the signing of the letter of intent which started the aggregation process between the two banks. An operation completed with the coordination of the Cassa Centrale Cooperative Banking Group, which identified in the two mutual banks the potential to create a new banking reality with technical and financial profiles of reference in a strategic economic area of the Veneto.

Thus a new entity is born within the regional Cooperative Credit, the third largest within the Cassa Centrale Banca Group, which takes the name of “BVR Banca Veneto Centrale”.

The new reality, led by general director Claudio Bertollo, will be operational starting from 1 July 2024.

With a widespread network of 87 branches, BVR Banca Veneto Centrale will be able to operate with its 586 employees within a territory of competence that extends between the provinces of Padua, Rovigo, Vicenza, Verona, Treviso and Ferrara, with borders in areas of Trentino and Lombardy. A strong social dimension of 19,500 members, including natural persons and legal entities, and 135 thousand customers.

The balance sheet numbers as of 31 December 2023 show, in aggregate form, that the new banking hub can count on overall collections of over 5.2 billion and loans of approximately 2.2 billion. Net assets are 378 million euros, with a Cet1 ratio of 26.09%. These data place the new reality among the top places for solidity within the entire national banking panorama.

“The new bank – assure the presidents Marangoni and Salomoni – will be bigger and more solid, while remaining faithful to the history and the link with the territories of origin, keeping intact the founding values of mutuality and cooperativism and the attention to the requests of families , businesses and communities, of a reference territory that will only be much larger”.