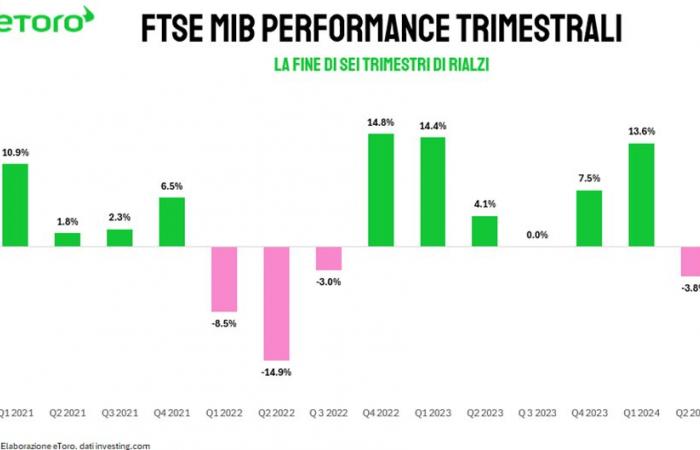

The second quarter of 2024 marked a setback for Piazza Affari, interrupting a positive streak that had lasted for six consecutive quarters, with a total return of 67%. The quarterly performance recorded a decline of 3.8% (higher than the median value of -3% on data since 1998), weighed down by the sell-offs in April and June, the latter exacerbated by political tensions in France. Out of 40 stocks, 20 closed the quarter in the red, even after adjusting for dividends. Stellantis (BIT:) lost 30% of its value, followed by Iveco with a decline of 22%. The industrial and consumer goods sectors were the most affected, while the financial sector shone thanks to the increases of Unipol (BIT:), MPS (BIT:) and BPER (BIT:).

A positive first half for Milan +9.2%, able to close in second place among the main financial centers of the Old Continent. Only the Dutch technology company +17.4% did better, supported by the AI monsoons with companies such as ASM +51.5% and ASML (AS:) Holding +41.4 in prominent positions. In Germany, Siemens Energy impressed with a gain of +102%, followed by Rheinmetall +69% and SAP +36%. In Spain, Banco de Sabadell (BME:) +62% and the pharmaceutical company Laboratorios Farmaceuticos Rovi +45% led the increases, the latter thanks to new approvals from the FDA. In the United Kingdom, Rolls Royce dominated the increases, joined by NatWest Group with a +42%. In contrast, the Paris stock exchange suffered from political uncertainty, seeing only 40% of its stocks gain, with Renault (EPA:) and Safran (EPA:) leading the way.

In the United States, markets showed more vitality than in Europe, thanks to the artificial intelligence industry. The closed up 17%, while the S&P 500 saw a 14.5% advance, with Nvidia making a significant contribution – accounting for 30% of the S&P 500’s gain and 32% of the 100’s. Other stocks such as Arm Holding and Constellation Energy performed strongly. In Asia, Taiwan’s TAIEX rose an impressive 28.5%, while Japan’s gained 19.1%, even outperforming Piazza Affari. The TAIEX’s success was driven by strong demand in the artificial intelligence sector, while the Nikkei benefited from the yen’s collapse.

It lost some of its gains in June, but still closed up 45%, becoming the best-performing asset. This result confirmed the growing interest of investors in cryptocurrencies, despite the market turbulence.

The combination of a strong financial sector and technological advances in the field of AI has contributed significantly to sustaining and often driving increases in global stock markets, outlining a landscape in which innovation and financial stability continue to be key drivers of success in capital markets. Adding to this growth is demand in the defense sector, in an international context that does not seem to see light at the end of the tunnel.

Volatility has returned to knock on investors’ doors, although still at low levels. The quarter opened and closed with shocks: first the Iranian missile attack on Israeli skies, then the winds of revolt in France, culminating with the victory of the right in the first round of legislative elections. These events have contributed to creating a climate of uncertainty in European markets that should continue in the coming months – from the second elections in France, to the English ones, culminating with the US ones.

One of the key elements that characterized the beginning of 2024 was the significant increase in commodity prices. From the rally in olive oil to chocolate, which worried consumers, to precious metals such as gold, silver and , the market saw impressive growth. Gold, the classic safe haven in times of uncertainty, recorded a significant increase. This increase reflects global economic uncertainties and the growing demand for safety by investors. Similarly, silver, used not only in the technology industry but also in renewable energy, benefited from this upward trend. Copper, on the other hand, which is essential for the industrial sector and infrastructure, saw a surge in prices, fueled by sustained demand and expectations of a robust economic recovery.

These increases have not only affected financial markets, but have also reflected evolving economic and geopolitical dynamics. Persistent inflation and geopolitical tensions have played a crucial role in shaping these trends, making monitoring commodity prices a vital indicator in understanding the future direction of the global economy.

Just looking at the market’s strong gains and the lack of any significant pullbacks so far this year, one might logically assume that this has been a “risk on” environment where riskier, higher-growth investments have seen all the premiums. You’d be wrong. Traditionally, defensive sectors like utilities, consumer staples, and gold have produced strong gains. Since mid-February, utilities and gold are up about 15%.

Even as Independence Day, July 4, shortens the week, Wall Street is bracing for a series of key economic data. Tuesday will kick things off with the Job Openings and Turnover Survey (JOLTS), followed by the ADP Private Sector Employment report on Wednesday. All of that will lead into Friday’s big news: the June nonfarm payrolls report.

The average of the last six months shows the creation of 255,000 jobs per month. Friday’s data will be particularly watched: if new hires reach or exceed 200,000, it will reinforce the idea of a robust economy and the policy of higher interest rates could continue. Otherwise, a reading below 180,000 jobs would suggest a cooling of the labor market, but not necessarily an imminent crisis. In addition to the jobs data, other key economic indicators such as the ISM Manufacturing and Services PMI, the FOMC minutes and the trade balance will be in the spotlight.

In Europe, attention will be focused on political developments and economic data. The French parliamentary elections see Le Pen’s party leading in the first round, followed by the left-wing New Popular Front and Macron’s party. The second round will take place on July 7. In the UK, polls suggest Keir Starmer’s Labour Party is likely to win, marking a turning point after 14 years of Conservative rule. Meanwhile, the ECB’s central banking forum will see crucial interventions by Fed Chair Powell and ECB President Lagarde. On the economic front, eyes will be on eurozone and German inflation data, which is expected to ease slightly, while the unemployment rate is expected to remain at a record low of 6.4%. German retail sales and factory orders will be closely watched, after months of decline. Other key data will include UK house prices, BoE monetary indicators and PMIs from several European countries.

This week will also be a big one for the auto sector, with crucial production and delivery data from major automakers. Tesla (NASDAQ:) will be particularly watched, with quarterly deliveries expected to decline due to demand concerns and registration data from Europe and China.

Gabriel Debach

eToro Italian Market Analyst

Disclaimer: This communication is for informational and educational purposes only and should not be considered as investment advice, a personal recommendation or an offer or solicitation to buy or sell any financial instrument. This material has been prepared without taking into account the investment objectives or financial situation of any particular recipient and has not been prepared in accordance with legal and regulatory requirements to promote independent research. Any reference to past or future performance of a financial instrument, index or packaged investment product is not, and should not be relied upon, as a reliable indicator of future results. eToro makes no representations and assumes no liability as to the accuracy or completeness of the content of this publication.