In the fascinating world of finance, where many graphs are intertwined with high-sounding article titles, with the seasoning of stratospheric numbers and to the rhythm of complex algorithms (in short, a true dance of cosmic chaos), there is an ancient asset that has shone for centuries of its own light, even if lately the dynamics are increasingly complex. Sorry for the initial pun, but it came out like this. Of course I’m talking about thegold.

This precious metal, as coveted as it is mysterious, has always exercised an irresistible fascination on man, acting as a store of value, status symbol and even object of worship.

Today, as the world watches with apprehension the geopolitical tensions and economic uncertainty that hover in the air, gold once again plays a leading role. The Central Banksthose powerful institutions that watch over the monetary and financial stability of their countries, are in fact considerably increasing their purchases of this precious metal.

But why this renewed interest in gold? The reasons are many and complex. There are those who see gold as a safe haven in times of turbulence, a tangible asset that does not fear inflation or currency fluctuations. Others, however, consider it a sort of “insurance policy” against potential geopolitical upheavals, an investment that maintains its value even when the world around us seems to be going crazy.

Among the largest buyers of gold is Russia, which has increased its reserves significantly since the start of the conflict in Ukraine. Also there China, always a great lover of the precious metal, has accelerated its purchases in recent months. Not least are the Central Banks of India, Turkey and other emerging countries, which see gold as a way to diversify their reserves and reduce their dependence on the US dollar.

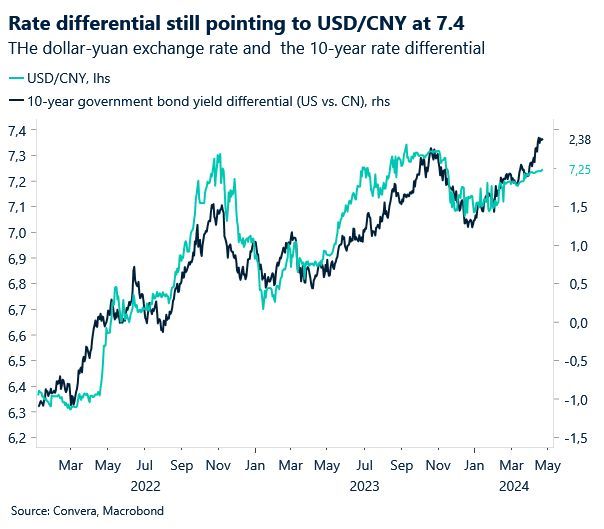

Let’s leave Russia aside and talk about China. A country that is selling US Treasury and becomes a net buyer of the yellow metal. The gold trading volume in China is now 400% higher than seen in 2023. Gentlemen, +400%! Gold trading activity on the Shanghai Futures Exchange increased to 1.3 million lots on the peak day last week. It’s okay to accumulate gold, it’s okay to no longer focus on the balance with the USD. But there’s something that doesn’t add up to me.

Let’s think for a moment.

What could make the difference is the role of PBoC. When the situation gets difficult, the Peoples Bank of China (PBOC) it could begin to push decisively with interventions that may even be incorrect but are now necessary to guarantee its objectives of controlling the cost of money and capital flows. And what could he do?

In summary, we can exclude a possibility a priori COMPETITIVE DEVALUATION?

So in my opinion the PBOC is preparing the ingredients to then create the recipe needed to weaken the Chinese yuan to put the economy on a path of sustained growth. Stimuli for exports and production. The consequences will be clear and rest assured that the FED and Washington will not stand by and watch. But let’s not forget that even in terms of public finances, today’s USA is not what it once was, and the carry trade dance could take over.

(Click here for further details)

This post is not to be considered as an offer or solicitation to purchase. Find out from your trusted advisor. If you are interested in the topics expressed here and would like to learn more about them, contact me!

NB: Attention! Read the disclaimer (for the avoidance of doubt!)

(If you find the contents of this article interesting, share it with your friends, click on the icons below, you will support the development of I&M!).

ℕ