Ftse Mib shares on important supports – Photo from pixabay.com

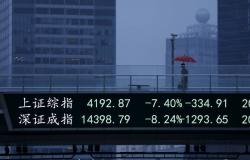

After last week’s sharp decline, European stock markets are struggling to regain direction. In fact, these price lists continue to move within the range of last Friday’s price bar. Which way will they come out? At the moment, the trend continues to be bearish and as long as this state remains, further declines will be projected in the coming days/weeks. In the meantime, Wall Street, however, continues to sail towards the highs and seems fully intent on wanting to rise further. Will it do this until our annual setup deadline on June 27th? We will see. Now we will analyze the Ftse Mib stock charts on important supports.

IS IN THE

The shares have moved in the 6.46 euro area in recent days. The Alligator Indicator on the daily and weekly time frames is set sideways with sideways/bearish divergences. Failure to rise in the next few days/weeks above the 6.739 area (high of June 11th) could lead prices in the next few weeks towards 6.142 where the 200-day moving average currently passes. The most important support at the moment is 6.254, a low marked on June 17th.

The average recommendations of analysts as reported by specialized magazines are as follows:

Buy with target at 7.527 euros. So, based on these assessments, at current levels the shares would be undervalued by around 16%.

Ftse Mib shares on important supports: Saipem

The shares have moved in the 2.06 euro area in recent days. The Alligator Indicator on the daily and weekly time frames is set sideways with bearish divergences. Failure to rise above the 2.16 area in the next few days (high of June 6th) could lead prices in the next few weeks to 1.8320 where the 200-day moving average currently passes. In recent days, prices have millimetrically touched a trendline which has supported the rise in recent weeks. Around the low of 1.9780 (marked on June 14th) the fate of these shares could be decided in the short term.

The average recommendations of analysts as reported by specialized magazines are as follows:

Buy with target at 2.74 euros. So, based on these assessments, at current levels the shares would be undervalued by approximately 31%.

Recommended reading

In which region can you buy a house by the sea for 1,100 euros per square meter? Let’s find out