Europe cannot sever the energy cord that still binds it to Russia and must still import liquefied natural gas from Moscow to avoid an energy shock. This is the warning from the EU energy regulator (Acer) following the request of a group of member states seeking to ban fuel purchases from Moscow. Looking at the data released by the European energy guarantor, it is clear why European states are now purchasing record quantities of LNG from Russia.

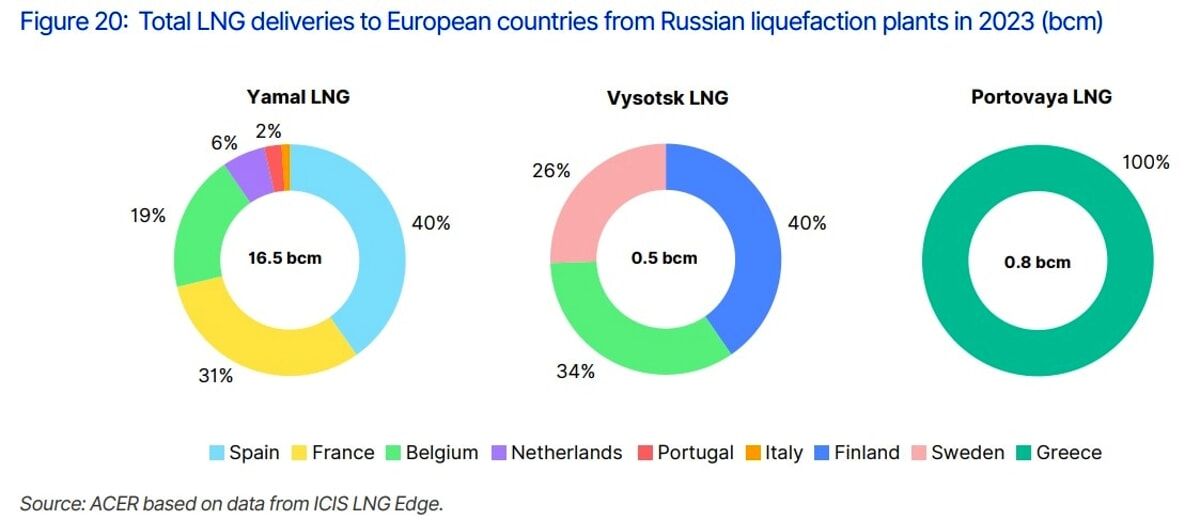

As the watchdog highlights in monitoring the European energy market, the global gas market is still tight. The undertaking to replace gas imports from Russia after the Kremlin’s invasion of Ukraine in 2022 ended up creating a new umbilical cord with Moscow. The data proves it: in 2023 European nations increased LNG imports from Russia by 40%, which has now become the bloc’s second supplier with 15.5 million tonnes of LNG.

Now Sweden, Finland and the Baltic states are pushing for the EU to impose an immediate total ban on the purchase of Russian LNG and a discussion is expected next week in the European Commission. But a warning comes from the supervisory authority: at the end of the year the transit contracts in the gas pipeline that directly links Russia to the European block will expire, a contract that will not be renewed and only the gas pipeline that passes under the Black Sea towards the Turkey and Bulgaria.

The EU wants to eliminate energy imports from Russia by 2027

A restriction of the market will only drive up prices and France and Germany are concerned about keeping energy costs low for industry. Cutting LNG is out of the question. To avoid an energy shock, all that remains is to continue financing Putin’s war which delivers 18 billion cubic meters of LNG to Europe, mainly directed towards Spain, France and Belgium.

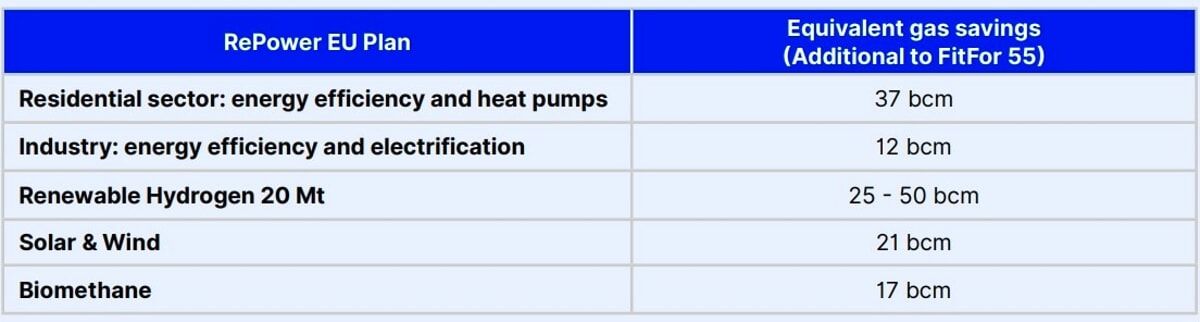

The European Commission wants to push member countries to close all energy imports from Russia by 2027, but time is running out and the next European elections could reshape the arrangements. In the meantime, the energy outlook is less pessimistic than in the past: in the world, LNG production and trade capacity has reached a new peak and the infrastructures built in the EU allow us to look to the future with optimism given the downward trend in gas prices already at pre-Russian invasion of Ukraine levels. Always trusting that the energy efficiency strategy implemented by Europe will make it possible to contain the demand for gas.

However, the full achievement of the objectives of the REPowerEU plan remains uncertain, particularly with regard to ambitious efforts such as the production of green hydrogen, which could prove challenging in light of current results. Several bottlenecks could put the objectives at risk, such as dependence on rare earths, the supply chain, but also the shortage of skilled labor.

To date, the main decrease in gas demand is due to the increase in prices which hit the industrial and domestic consumption sectors: a decline which, given the economic stagnation, has been structurally maintained.