- Markets continue their downward momentum, despite a positive start to the Q1 reporting season

- The LERI shows business uncertainty recovering, after the decline in Q4

- All eyes are on the Magnificent 7: Tesla (TSLA), Meta (META), Alphabet (GOOGL) and Microsoft (MSFT), which will release results this week.

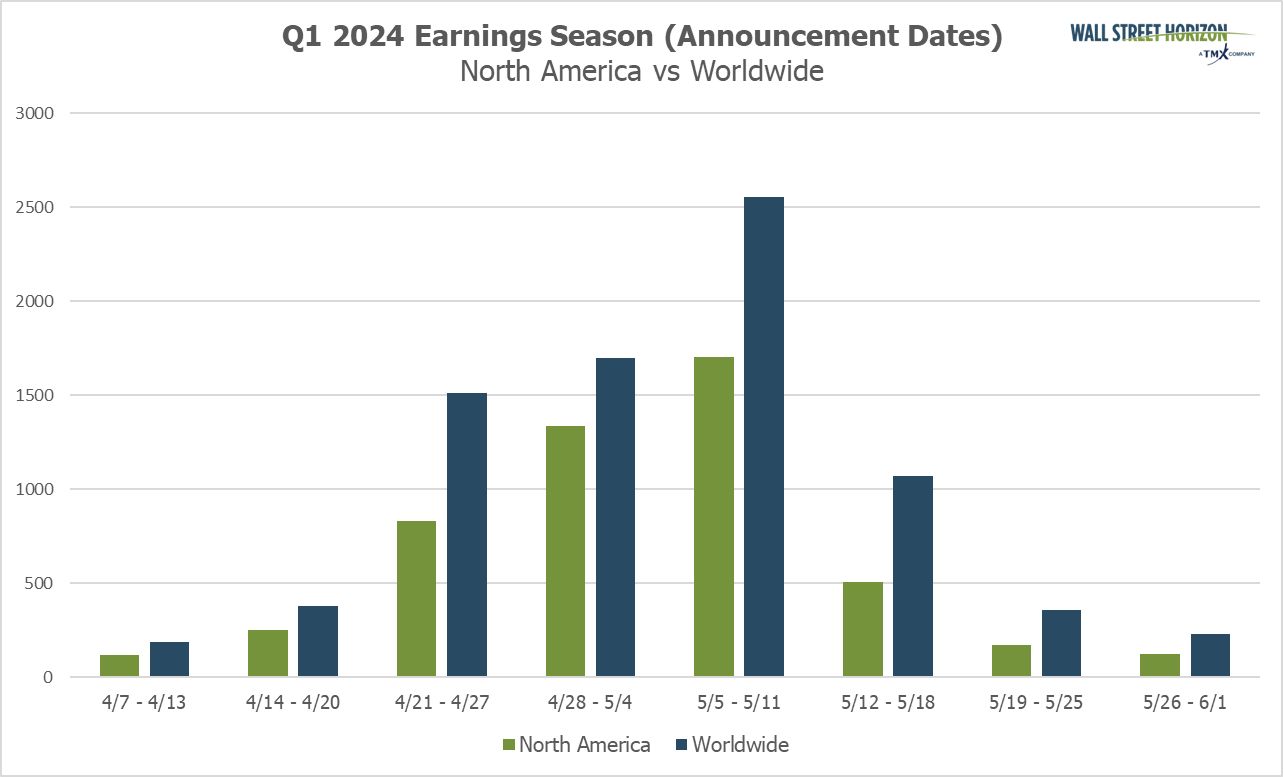

- Peak weeks for the Q4 season are April 22nd through May 10th

Can Big Tech Turn the Markets Around? Or are investors too blinded by the Fed’s words?

US markets continued their downward trajectory last week, despite some decent quarterly reports. The index is headed for its longest decline of the year, falling for 6 days in a row, as investors continue to focus on inflation, Fed comments and the realization that interest rate cuts may not arrive until 2025.

Last week saw good results from investment banks like Goldman Sachs (NYSE:) and Morgan Stanley (NYSE:) on Monday and Tuesday, followed by better-than-expected results from United Airlines (NASDAQ:) on Tuesday afternoon. The international carrier’s shares jumped 17% after Q2 forecasts beat Wall Street’s estimates, a sign of a strong start to the travel season.

The party continued on Thursday, with solid results in the tech and communications services sectors. Taiwan Semiconductor Manufacturing (NYSE:) reported strong results before the bell, on the back of strong demand for AI chips. Another highly anticipated name, Netflix (NASDAQ:), released data after the bell.

Third Party Advertisement. This is not an offer or recommendation by Investing.com. Consult the information here or

remove ads

.

The impressive results showed that cracking down on password sharing continues to pay off, with total subscribers jumping 16% in Q1. Nonetheless, the stock fell after the report, with Netflix saying it would no longer report subscriber data starting in 2025 and investors focusing on inflation and geopolitical tensions.

Despite better-than-expected results last week, downward revisions for companies that have yet to release data led to a decline in the S&P 500’s overall EPS growth rate for Q1. According to FactSet, current estimates are +0.5%, compared to 0.9% last week. So far, 74% of companies reporting results have beaten analysts’ estimates.

Investors react more to lukewarm comments from CEOs than to Q1 results

Despite better-than-expected results so far this quarter, investors are rewarding companies with less than average positive surprises, and punishing more than average negative surprises. What happens? It probably all depends on the comments. While many companies have managed to put together impressive results for profits and sales, future estimates and general commentary have been much more conservative.

Our Late Earnings Report Index (LERI) has embraced this trend and shows that US CEOs may be more uncertain in Q2 than last quarter.

The LERI index tracks changes in quarterly reporting dates among publicly traded companies with market caps of $250 million or more. The LERI has a base reading of 100. A value above this level indicates that companies feel uncertain about the current and short-term outlook. A LERI reading below 100 suggests that companies feel they have a good crystal ball for the short term.

Third Party Advertisement. This is not an offer or recommendation by Investing.com. Consult the information here or

remove ads

.

The official peak pre-season LERI reading for Q1 (data collected in Q2) stands at 114, again above the baseline reading, indicating that companies are feeling less confident about economic conditions than at the start of the year. year. As of April 12, there were 43 late and 34 early exceptions.

Source: Wall Street Horizon, 2020 is ruled out due to unusually large number of delays.

The Magnificent 7 are expected this week

This week it is the turn of the big techs, in particular the Magnificent 7, of which 4 will publish the results. We’ll have Tesla (NASDAQ:) with Q1 2024 results this Tuesday after the bell, Meta (NASDAQ:) on Wednesday, and Microsoft (NASDAQ:) and Alphabet (NASDAQ:) closing out the week on Thursday.

Intel (NASDAQ:) is not part of the Magnificent 7, but is expected to experience one of the highest growth rates in the S&P 500 tech sector due to continued demand for generative AI products. According to FactSet, the tech giant is expected to report EPS growth of 475% YoY.

Source: Wall Street Horizon

Rain of Q1 quarterly reports

The peak weeks will be between April 22nd and May 10th: each week will see over 1,500 reports. At the moment, May 9th is expected to be the busiest day, with 1,236 companies reporting results. So far only 59% of companies have confirmed their results date (in our universe of over 10,000 global stocks), so there will be some changes. The remaining dates are estimated based on historical data.

Third Party Advertisement. This is not an offer or recommendation by Investing.com. Consult the information here or

remove ads

.

Source: Wall Street Horizon

Tags: Magnificent Results Falls Expect